Ultratech Cement is the industry leader in the cement sector, generating revenues in excess of ₹ 35000 crore last financial year.

Shree Cement is the fourth biggest in terms of revenues, behind Ambuja Cement and ACC – but Shree Cement is India’s second most-valued cement company in terms of market capitalisation.

The Top 4 Cement Companies (Market Capitalisation)

- Ultratech Cement – 1,26,000 crore

- Shree Cement – 86,000 crore

- Ambuja Cements – 42,000 crore

- ACC – 26,000 crore

Shree Cement is the most expensive cement company among large firms, commanding a significantly higher premium over Ultratech Cement.

Price-to-earning (PE) multiple of large cement companies:

- Shree Cement – 64 P.E

- Ultratech Cement – 35 P.E

- Ambuja Cements – 20 P.E

- ACC – 19 P.E

So the question arises, why does the market value Shree Cement the highest – even though it isn’t a pan-India player yet.

The answer lies in the business model and efficient management of Shree Cement.

The company has the lowest power and fuel expense as compared to its peers. It generates energy using waste-heat recovery mechanism. The waste from a plant is recycled to generate power.

Under the leadership of Hari Mohan Bangur, Managing Director of the Kolkata-based company, Shree Cement generates more power than it uses and sells the surplus. The power business now contributes 7% to its total revenues.

The company has also steadily increased its production capacity over the last 15 years and expanded its business into states like Bihar, Chattisgarh and Karnataka.

The combination of a quality management, steady growth and huge future potential – has resulted in the market giving the highest valuation for the company among its peers.

Shree Cement has also created tremendous wealth for its shareholders. ₹ 10,000 invested in the company in 1985 would be valued at ₹ 4.46 crore today (25th February 2020) – returns of 27.17% CAGR!

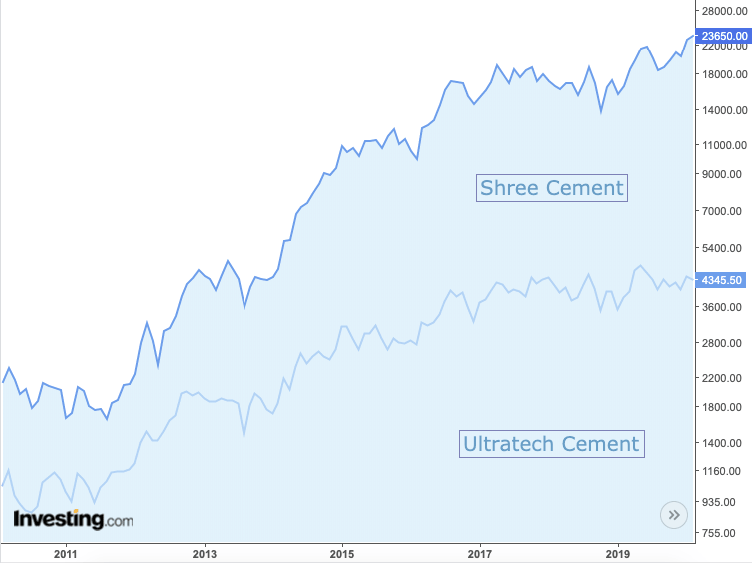

A quick comparison between Ultratech Cement and Shree Cement for the last 10 years.

| Share Price | Ultratech | Shree |

| 10 Years Ago | ₹ 1030 | ₹ 2180 |

| 5 Years Ago | ₹ 3040 | ₹ 10840 |

| 3 Years Ago | ₹ 3790 | ₹ 15950 |

| 1 Year Ago | ₹ 3716 | ₹ 16515 |

| Today (Feb 2020) | ₹ 4400 | ₹ 23830 |

Clearly, there is no comparison. Ultratech Cement has given very good returns of 15.63% CAGR over the last 10 years. This is more than double the returns that investors would get from a fixed deposit.

But like H.M Bangar, M.D of Shree Cement said in the latest Annual Report of the company, “There are players in any given sports field. But there is only one champion”.

Shree Cement is the champion of the cement sector.

The company has given outstanding returns of 27.02% over the last 10 years. And this does not include income from dividends.

1 lakh invested in Ultratech Cement would be around 4.3 lakhs today, whereas the same amount invested in Shree Cements would be 11 lakhs!

It’s superb quality and best price complimenting

MAHALAXMI STEEL TRADERS NARGUND dealer