A company that is listed on the stock market has to announce its financial results every quarter.

A financial year begins on April 1st and ends on March 31st.

After the end of each quarter (period of 3 months), a company will declare its financial results.

- Quarter 1 (Q1) – April to June

- Quarter 2 (Q2) – July to September

- Quarter 3 (Q3) – October to December

- Quarter 4 (Q4) – January to March

The full-form of YoY is ‘Year On Year’ or ‘Year Over Year’. That means, the quarterly results of this year is compared to the quarterly results during the same period last year.

In other words, the financial results of Q1 2019 is compared to Q1 2018.

When a company has shown growth in sales and profits when compared to the same quarter last year, the results are considered to be good.

How to Calculate ‘Year Over Year’ growth?

- Get the financial results from the balance sheet of a company.

- Choose which time period (e.g quarter) you want to calculate YoY growth.

- Subtract last year’s number from this year’s number.

- If the number is positive, there has been growth.

- If the number is negative, there has been de-growth.

Now that you have the number, it’s easy to calculate the growth percentage.

YoY Growth Simple Example

Let’s assume a company called ‘ABC Ltd’ has earned profit of ₹ 10,000 in Q4 2019.

In Q4 2020, the company has earned profit of ₹ 12,000.

How much is the year on year profit?

Q4 2020 – Q4 2019. 12000 – 10000 = 2000.

The company has shown growth in profit.

To get percentage, let’s apply the formula:

The YoY growth of ‘ABC Ltd’ is 20%.

YoY Growth Real Example

To understand and begin using YoY on real companies, let’s take example of Bajaj Finance.

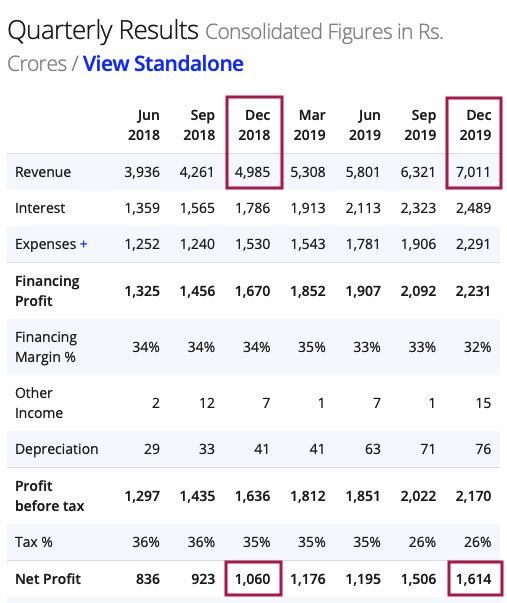

Ignore everything you see in the image below, except the numbers in the pink box.

The first line of numbers is ‘Revenue’ which can also be called total earnings before deducting any expenses or taxes.

The last line of numbers is ‘Net Profit’ which is the total profit a company has earned after deducting everything.

Now, for our example, we will compare the revenue and profit growth percentage between Q3 2018 and Q3 2019. I.e the same period of October to December in 2018 and 2019.

To calculate revenue growth percentage, let’s apply the same formula.

The way to calculate would be:

- 7011 – 4985 = 2026 (Total Revenue Growth)

- 2026 / 4985 = 0.4064 multiplied by 100 = 40.64% (Revenue Growth Percentage)

If you understand the logic, the calculation is simple.

Profit growth calculation is similar:

[ (1614 – 1060) / 1060 ] * 100 = 52.26%

Bajaj Finance has shown revenue growth of 40.64% year over year and 52.26% profit growth YoY.

If you have any doubts, feel free to ask your questions in the comments section below.

Leave a Comment