Recently, there has been a lot of talk around ‘V Shape Recovery’ in the market. But what exactly is a ‘V Shaped Recovery’ and how does it look?

There are two parts; one is the word ‘recovery’ which means the price has to first fall and then recover. Second is the shape, which is V.

This means, the price has to fall sharply and then recover quickly to go back close to where it was.

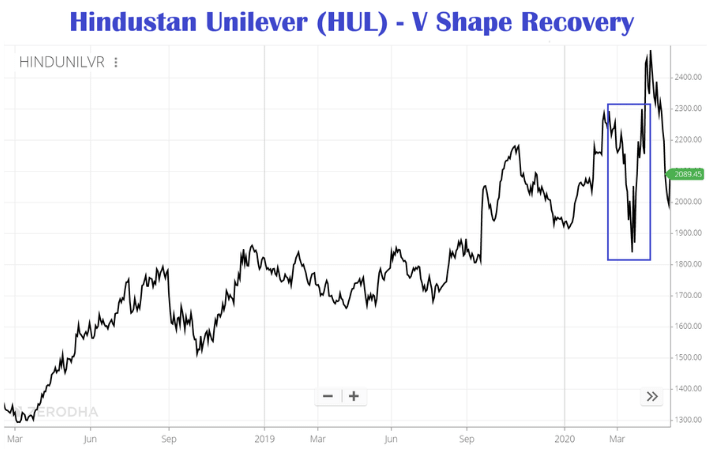

Check out this chart:

The above chart is of Hindustan Unilever (HUL).

During the initial Coronavirus market crash, HUL crashed from ₹2300 per share to nearly ₹ 1800 per share. That crash did not last for long, as the stock quickly recovered and went past its previous high.

This kind of crash and immediate recovery looks ‘V’ shaped on the chart – hence it is called ‘V Shaped Recovery’.

There are other shapes of recovery too like ‘U Shaped Recovery’, ‘W Shaped Recovery’ and ‘L Shaped Recovery’. These will be discussed in separate articles.

Economic recessions which are short – where the GDP falls and rises within a couple of quarters – are also called ‘V Shape Recovery’.

This form of recovery is also applicable for businesses – where sales can fall and rise quickly. Almost all companies could show close to ‘V Shaped Recovery’ when the COVID19 lockdown ends.

Leave a Comment