When a stock opens higher than the previous day’s price, it’s called a ‘gap up opening’. It’s a positive sign for a stock as gap up opening happens due to higher demand to buy the shares of the company.

For example, if a stock closes at ₹ 300 on Monday and opens at ₹ 320 on Tuesday, there is a gap of ₹ 20 between the price on the previous day and the opening price on the next day.

When this gap is on the higher side, it’s called a ‘gap up opening’.

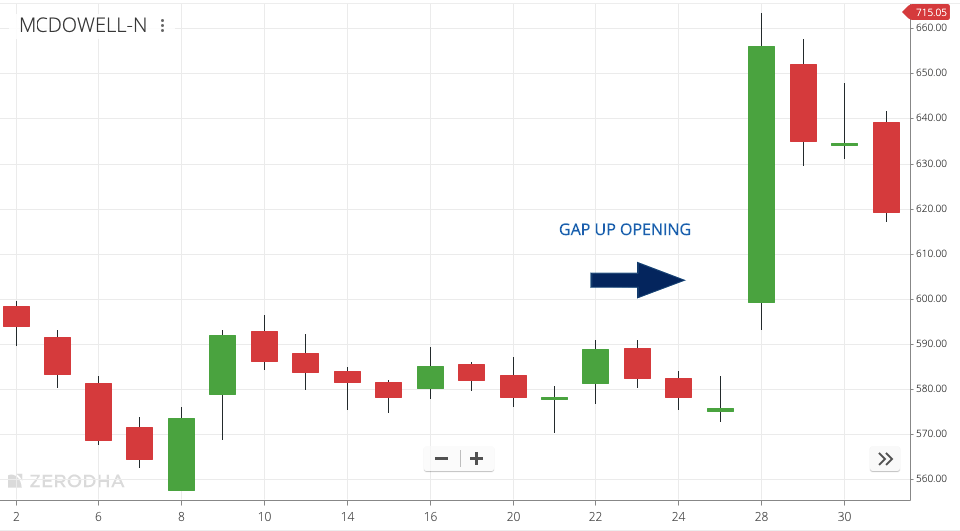

Let’s take a real example of United Spirits (McDowell):

On 27th January 2020, United Spirits closed at ₹ 575 per share. On the next day (28 Jan), the stock opened at ₹ 599. There was a gap of ₹ 24 between the closing price on the previous day and the opening price on the next day.

When this happens, we say ‘United Spirits opened gap up’.

The question arises, why did United Spirits open higher on that day?

The company was scheduled to announce its quarterly financial results on 27th January after market hours. The results were excellent, the profits of the company jumped 35%.

Usually, when a company announces better-than-expected financial results, there is increased demand to buy the shares. The next morning (28 Jan), the orders to buy the shares were high. Classic case of higher demand and lesser supply. The price shot up and we had a gap up opening.

Similarly, Gap Up openings can happen due to various reasons – both known and unknown. It could be because of news, positive market sentiments, budget announcements, positive financial results and several others reasons.

Partial Gap Up and Full Gap Up

Gap Ups can further be divided into two categories:

- Partial Gap Up: When the opening price is higher than the ‘closing’ price on the previous day.

- Full Gap Up: When the opening price is higher than the ‘highest’ price of the previous day.

Leave a Comment