‘Cum Dividend’ means ‘With Dividend’. If shares are purchased on this date or before, you will get dividend in your bank account.

If shares are purchased after the ‘Cum Dividend’ date, you will not receive any dividend.

On most websites, the ‘Record Date’ and ‘Ex-Dividend Date’ is mentioned. But the ‘Cum Dividend’ date is not displayed.

‘Record Date’ is when the shares need to be in your demat account.

Whenever you buy shares, it takes two working day for the shares to be ‘Delivered‘ to your demat account.

‘Ex-Dividend Date’ is one working day before the ‘Record Date’. On this day, you can sell your shares and still get dividend. But if you buy shares on this date, you will not get dividend.

‘Cum Dividend’ is two working days before ‘Record Date’ and one working day before ‘Ex-Dividend Date’. This is the last day to purchase shares to get dividend, which a company has announced.

| Cum Dividend | April 1st | Last date to buy shares |

| Ex Dividend | April 2nd | Can sell shares, but still get dividend |

| Record Date | April 3rd | Company finalises dividend pay out list |

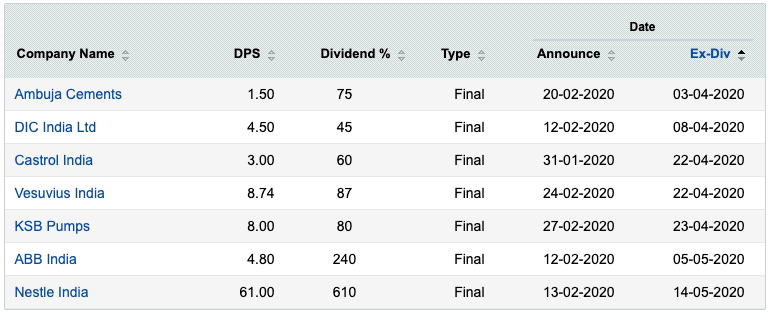

The image above is a list published by Economic Times of upcoming dividends.

In the first column, the company name is mentioned.

The second column ‘DPS’ means Dividend Per Share. If you hold 1 share of Ambuja Cements, you will receive ₹ 1.5. If you hold ten shares, you will get ₹ 15. And so on.

The third column is ‘Dividend Percentage’ – which is based on Face Value of the share. The Face Value of ‘Ambuja Cements’ is ₹ 2. When the dividend is declared as 75%, it means 75% of ₹ 2 which is ₹ 1.5 per share.

The fourth column is the ‘Type’ of Dividend – which can be Final or Interim.

The fifth column has the ‘Announcement Date’ i.e the date on which the company announced the dividend. It is usually 2-4 months before the dividend is paid.

The sixth column is the ‘Ex Dividend Date’. You can sell your shares on this date and still get the dividend.

From the image above, let’s take the example of ‘Nestle’.

To get the ₹ 61 per share dividend of Nestle:

- Announcement Date: 13th February 2020

- Cum Dividend Date: 13th May 2020 (Buy shares on this date or anytime before to get dividend)

- Ex Dividend Date: 14th May 2020 (You can sell shares of Nestle, but still get ₹ 61 per share as dividend from the company)

- Record Date: 15th May 2020 (The company finalises the list of shareholders who are eligible to get dividend)

Note: If you are an existing shareholder of the company, you will still receive dividend. All you need to do is, make sure you do not sell your shares on or before the ‘Cum Dividend’ date.

Leave a Comment