’52 Week High’ is the highest price of a stock in the last one year. It can also be called ‘1 year high’ because one year has 52 weeks.

When you hear analysts on business channels (CNBC etc) say “Reliance Industries has hit 52 week high” – it means the stock of the company is currently at its highest price in the last 52 weeks or one year.

Should you buy stocks at 52 week high?

There are a lot of experienced investors who believe in buying stocks that are at ’52 week high’. The reason is simple – the stock price goes up when demand to buy the share is more than the supply (i.e more buyers and less sellers). If people are consistently bidding higher to buy shares of a company, there could be many reasons why they are doing so.

The company could be fundamentally strong and an industry leader in its sector. For example, at the time of writing this article, Asian Paints is very close to its all-time high and there are multiple reasons for that. It’s the biggest company in the paint business and they have consistently grown at a healthy rate for many years. With the government promising ‘housing for all’, paints will be in high demand in the next few years and Asian Paints is expected to benefit the most.

Companies that have good corporate governance and an honest management also get premium valuation at the stock market. In a country like India, where corporate governance is a major issue, you’ll find that companies with a good track-record will always be consistently hitting new ’52 week highs’.

You have to be careful though, because there could be several negative reasons too. If a stock has doubled or tripled in the last one year, it’s always better to wait for the stock to correct. Check the valuations, study the business and only after doing your analysis, buy the company that you like.

Also, you have to be very careful before buying small or micro cap companies that are hitting new highs. The stock could be manipulated by ‘operators’ or big investors.

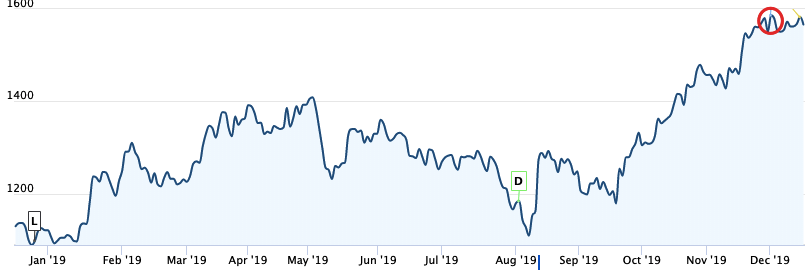

The other negative reason for a stock to hit new highs could be greed and euphoria among investors. For example, when a stock is consistently hitting ’52 week highs’, it gets a lot of publicity in the media and this attracts more investors. That’s when demand to buy increases and sellers are less because very few people want to sell a rising stock. This is what creates something that is commonly called as a ‘bubble’. When a stock rises way above its intrinsic value, a ‘bubble’ of sorts is created and when it ends, the stock price comes crashing down.

Analysis is the key, but buying stocks at ’52 week high’ – especially in a bear market – could be a better idea than buying a company that is hitting new lows.

Leave a Comment