A ‘Spinning Top’ is a single candle stick pattern, which forms when there is indecision.

Both the buyers and sellers were active in the stock, but both could not take control.

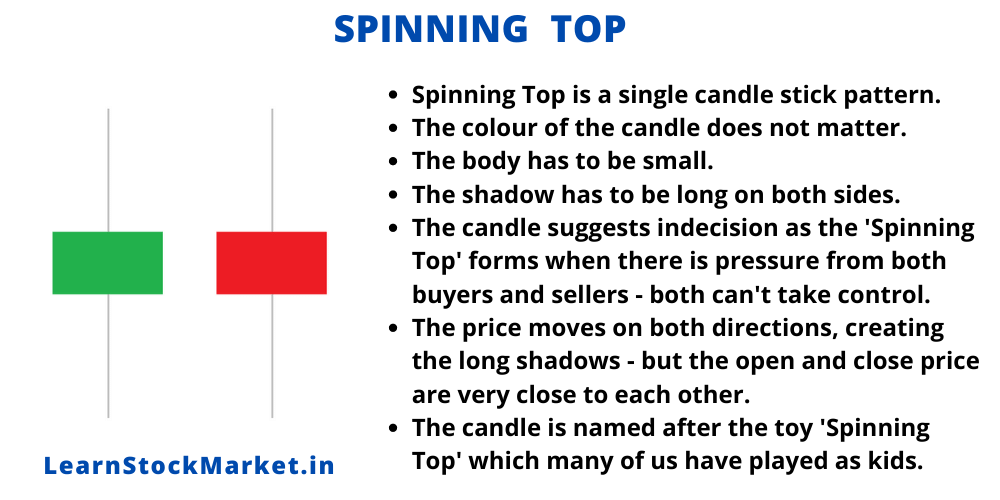

This is how it looks:

The ‘Spinning Top’ has a small body. It can either be red or green, the colour does not matter.

More importantly, it has to have a large shadow at the top and a large shadow at the bottom of the candle.

Let’s take an example to understand how the ‘Spinning Top’ gets formed on the chart:

- The price of a stock called ‘ITC Ltd’ opened at ₹ 200.

- It fell to ₹ 190 in the morning. The sellers (bears) are trying to take control.

- The bulls start buying in the afternoon, the price went up to ₹ 215.

- The bears start selling again, which gets the price down to ₹ 202.

- The opening was 200, the close was 202 – which means a small green candle.

- The price fell to 190 and rose to 215 – which means long shadows on both sides.

- Both bulls and bears failed to take control and the price closed very close to the price it opened.

The above price movement would look like a ‘Spinning Top’ on the chart.

Spinning Top Trading Strategy

On its own, the ‘Spinning Top’ candle is indecisive. Both the bulls and bears tried to take control, but failed.

However, the ‘Spinning Top’ has significance if it appears during a trend.

If the Spinning Top appears during a downtrend, it could suggest a potential reversal in trend.

In other words, a stock was going down from quite sometime. On the day when the ‘Spinning Top’ gets formed – the sellers tried to take the stock further down. The buyers saw value in the stock and began purchasing it.

When the stock price – which was moving down until then – suddenly begins to go up, the bears (sellers who are short on the stock) start to get uncomfortable and begin covering their shorts. This pushes the price further up.

Then, seeing the big movement on the upside, the selling pressure builds up again – and the stock price comes down. It closes at around the same price to where it opened.

The indecision was there, but for the first time in the last few days – a stock which was moving downwards, is looking interesting to the buyers. This movement could be an indication that the stock might rise up in the next few days.

If the ‘Spinning Top’ appears during an uptrend, it could again mean a change in trend.

A stock was rising steadily for the last few days. Suddenly, there is selling pressure and the stock forms a ‘Spinning Top’. This, again, could be an indication that the stock might have created a short term top.

It’s important to note that trades cannot be taken solely on the basis of ‘Spinning Tops’ getting formed on the chart. This candle gets formed frequently on the chart. It should be used in combination with other indicators.

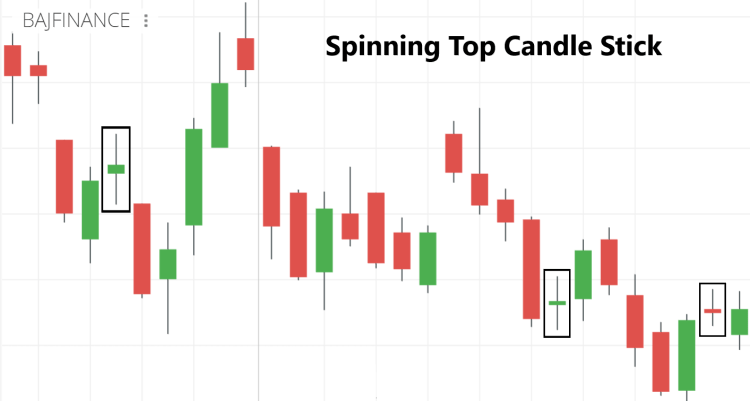

Spinning Top Example on Chart

The above chart is of ‘Bajaj Finance’.

The chart has several ‘Spinning Top’ candles. Some people might even call it a ‘Doji’ candle, but the shadows are large.

Spinning tops can appear at any time and each time they appear, it’s an indication that the battle between the bulls and bears is inconclusive.

Hence, you cannot execute trades simply based on the appearance of a ‘Spinning Top’. The stock could go in any direction on the next day.

It’s important to use other technical indicators along with common sense and trading experience – which only comes with time spent practicing and learning.

Leave a Comment