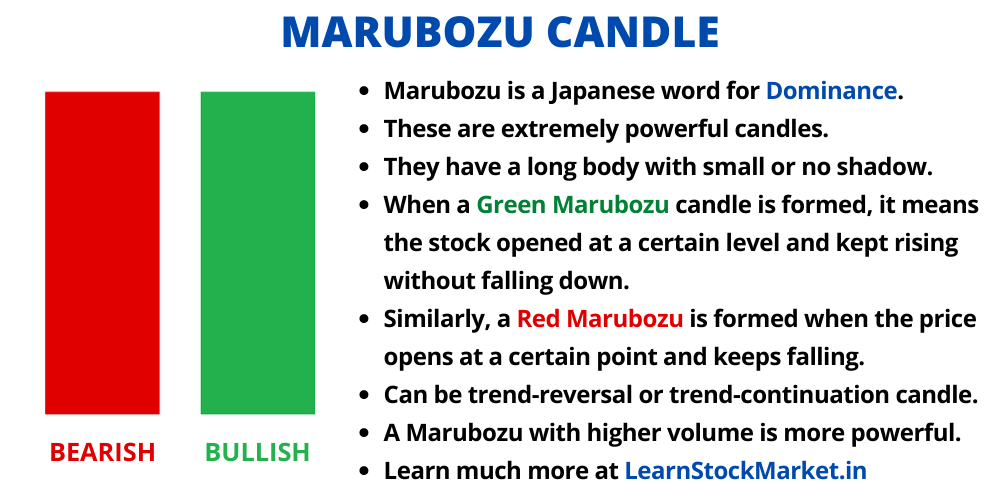

Marubozu is a simple one-candle pattern, which is easy to identify on the chart.

When a candle is large in size and green in colour, it’s a Bullish Marubozu.

When a candle is large in size and red in colour, it’s a Bearish Marubozu.

It’s as simple as that. No wick or shadow to the candle, just the long body. That’s a Marubozu.

Marubozu is a Japanese word for ‘Dominance’. Big large candles on the chart can be extremely powerful, especially when they are accompanied by high volume.

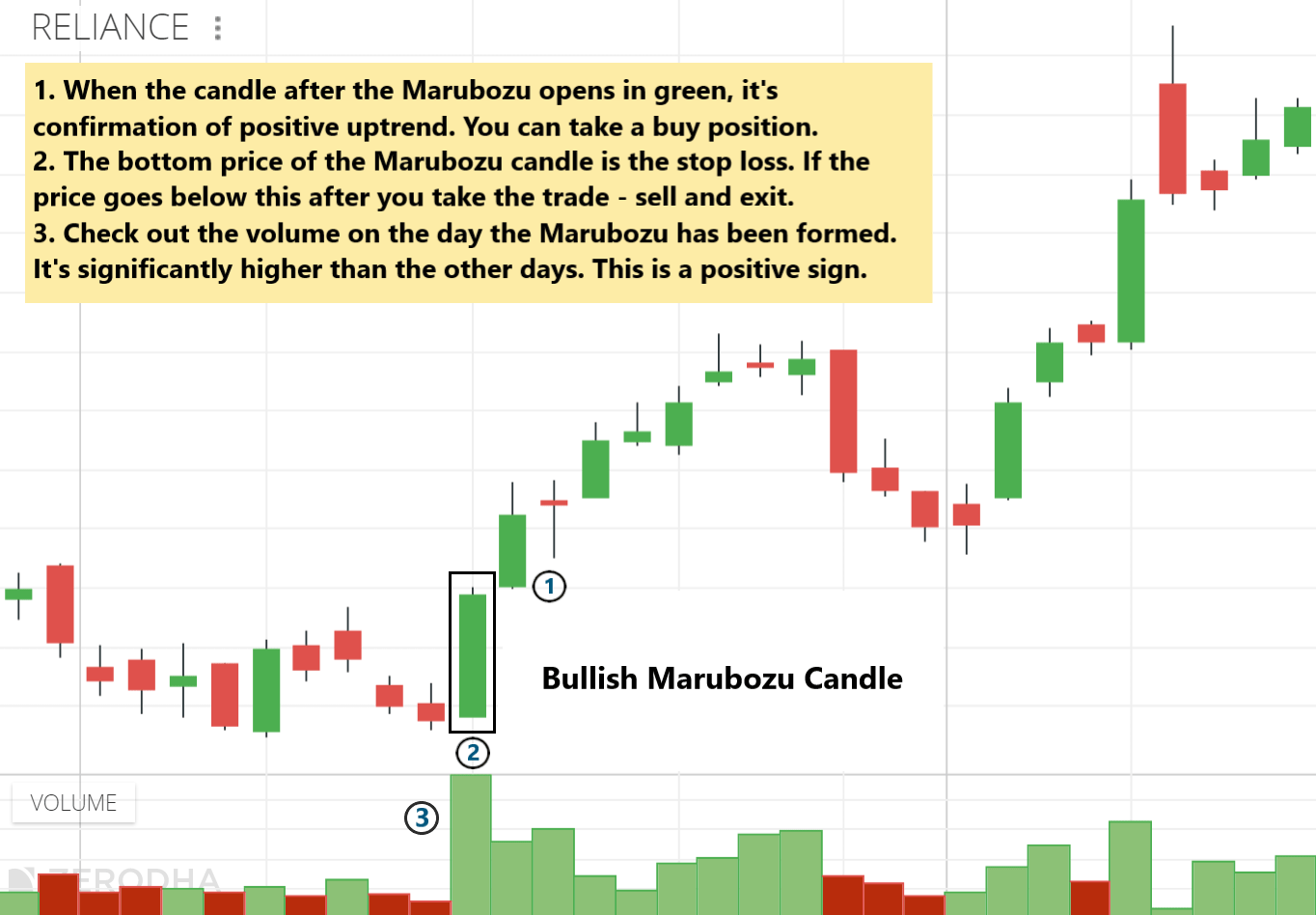

Bullish Marubozu

It does not matter if a stock is in downtrend or uptrend, when a Bullish Marubozu (large green candle) appears on the chart, it’s considered to be a very bullish sign.

It means at that particular price point, a big investor who is bullish on the stock – could have taken a position.

Think about it. A Bullish Marubozu gets formed when the price opens at a certain level, keeps rising and closes strongly. This means, the bulls are completely in control and the bears were either too few in numbers or weren’t able to make much difference.

In other words, there was buying in significant quantity with very few sellers. This can also happen when there is a very positive news, or when a company announces better-than-expected financial results.

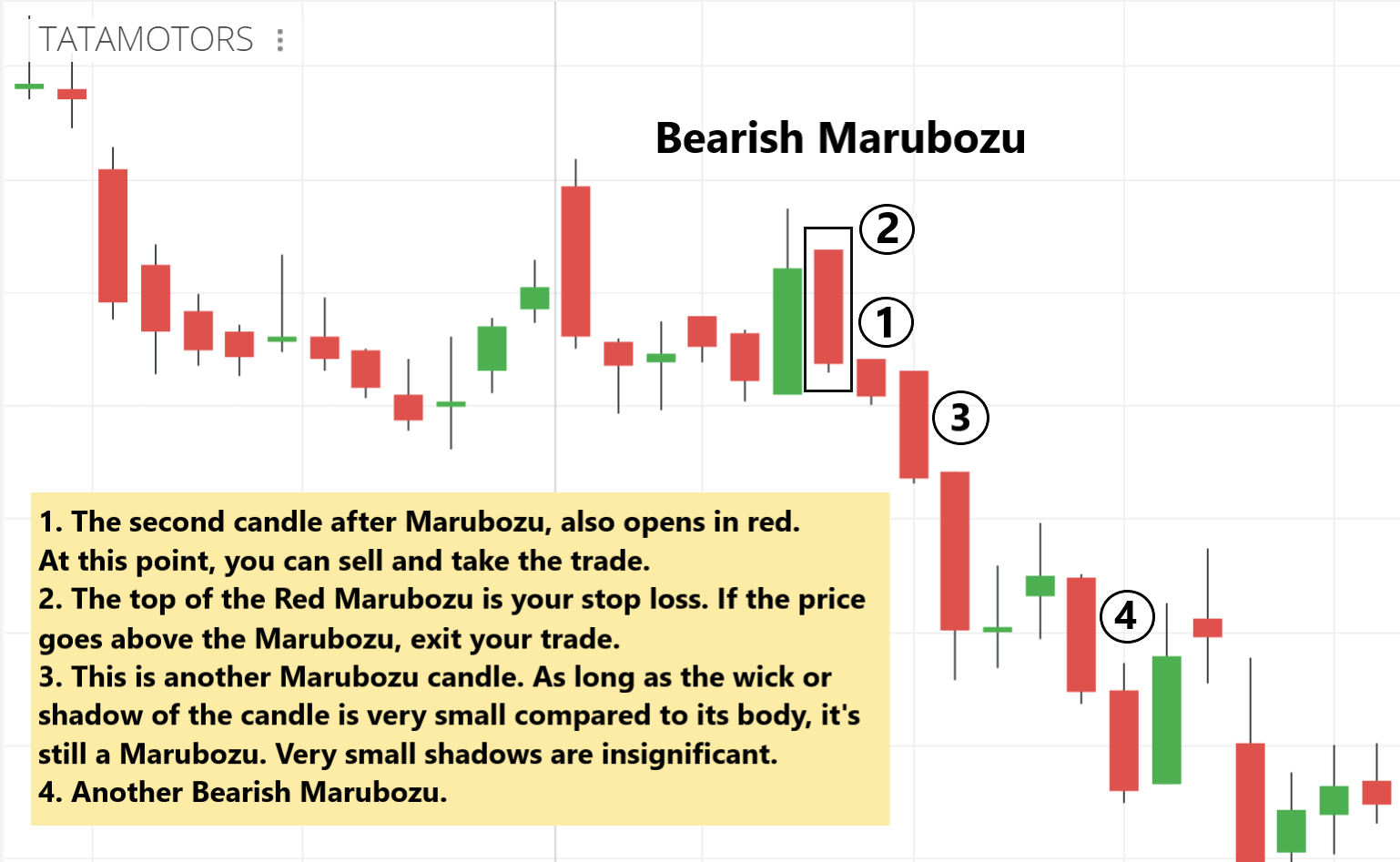

Bearish Marubozu

It’s exactly the opposite.

When a Bearish Marubozu (large red candle) appears on the charts, it’s a sign of bearishness.

A Bearish Marubozu gets formed when the price opens at a certain level, falls and closes weakly. The bears are in complete control of the stock.

A big investor or some institution could’ve cut their position in the stock.

This can also happen if there is a bad news related to the company or if a company announce financial results that are below expectations.

Marubozu Example

The above chart is of Reliance Industries. The stock formed a ‘Bullish Marubozu’ candle.

It was an extremely bullish candle. Take a look at the volume on that day. It was significantly higher than the last few days – almost 9 times volume compared to the previous day.

If you took a buy position there, you would be still holding the stock – as the price has never fallen below that Marubosu candle.

The price was 678 on that day and today Reliance is quoting 1431.

Obviously, holding the stock for such a long period of time is extremely difficult for traders with a short term view – especially when the trailing stop loss can get hit quite frequently.

Another example:

The chart above is of the Automobile company ‘Tata Motors’.

There are several ‘Bearish Marubozu’ candles in the chart. One such candle has been highlighted within the black box.

You can short sell the stock when the candle after the first bearish Marubozu is also red. The stop loss will be the top of the red Marubozu.

If the price goes above, you need to exit the trade immediately as the Marubozu has failed.

Also note, small wicks or shadows (the small line below the candle) can appear. It doesn’t make much difference because small shadows mean the price only managed to recover a little. It’s insignificant.

SIMPLISITY TO UNDERSTAND

Superb explain sir. thanks a ton