The ‘Cup and Handle’ is a pattern which forms on the chart when a rising stock – goes through both price correction and time correction.

Price correction is when the price of a stock falls.

Time correction is when the price moves around the same range for an extended period of time.

The ‘Cup and Handle’ is a bullish trend-continuation pattern. This means, it forms when a stock is in long-term uptrend – it undergoes correction – and then resumes its upward movement.

Cup and Handle Pattern Formation

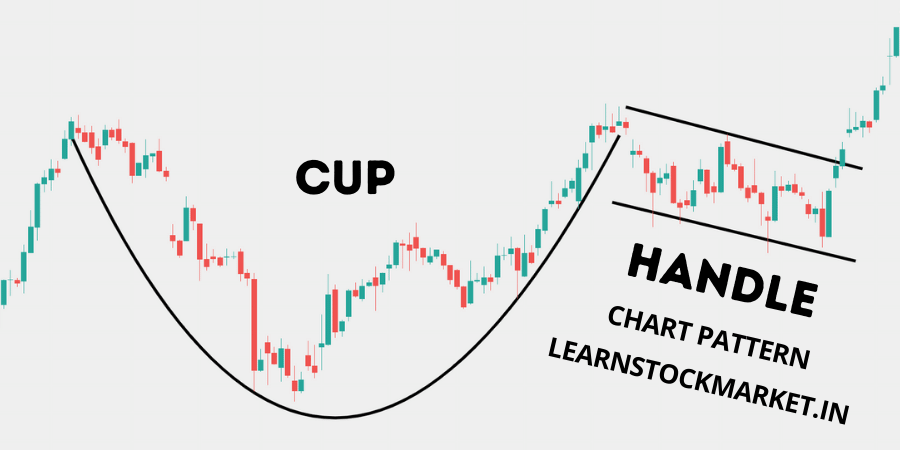

When the price gradually falls, goes sideways and then rises back to its previous level – it forms a ‘U’ shape on the chart. This is the cup.

After the formation of the cup, the price falls again – moving in a sideways to downward direction. This forms the handle of the cup.

Together, the entire formation looks like a cup with a handle. This is why it has been given the name ‘Cup and Handle Pattern’.

Example (try to imagine the price movement in your mind as you read):

- A stock is at ₹ 100 when it starts to fall.

- It gradually falls to ₹ 90 and then to ₹ 80.

- It begins to move sideways in the ₹ 75 to 80 range.

- Then slowly starts moving upwards. From 80, the price rises to 90 and eventually back to its previous high of 100.

- This price movement on the chart will look like half a circle or ‘U’.

- Now the price again drops to 95. It removes the ‘weak hands’, before continuing its larger trend in the upward direction.

On the chart, this price movement will look like a ‘Cup and Handle’.

The pattern can form across all time frames and can be used for intraday trading, short-term swing trading and as well as longer-term positions.

From my personal experience, the ‘Cup and Handle pattern’ is more effective on longer time frames like the ‘Daily’ chart.

If the cup and handle pattern is found on ’15 minute’ or lower time frames, it can be used for taking intraday trades on the buy side.

If the pattern is found on longer time frames – 30 minutes up to daily chart – it can be used for swing trading as well as positional trades.

Quick Tips:

- Do not look for exact rounding shape pattern. The price movement can be up and down.

- Always remember, no pattern is 100% accurate. Always keep a stop loss and be disciplined.

- The success or failure of the ‘Cup and Handle pattern’ can also depend on the market sentiment and other factors.

Cup and Handle Pattern Psychology

When a stock has been in an uptrend, it cannot forever move in one direction. There has to be a pullback before the trend continues.

The pullback first, consolidation next and eventual rise – gives it the necessary strength to continue its journey upwards.

The psychology is simple. When a stock has moved up a lot, selling pressure increases. Institutional investors (big players) would want to book profits, this brings the price of the stock down.

After the price corrects, it remains in a range as there is both buying and selling pressure. Meanwhile, the fundamentals also begin to move closer to the price.

The bulls (buyers) begin to take control. The price gradually moves in the upward direction and returns back to its previous high.

Near its top, which is now a resistance, selling pressure comes in. The weaker hands begin to move out during this small ‘shake-off’ phase.

After the formation of the handle, if the buying remains strong – which should be visible from higher volume – the stock is preparing itself to break its previous high and continue its uptrend.

The entire cup and handle pattern is nothing but a ‘correction’– allowing the fundamentals to catch-up before starting a fresh move upwards.

How to trade Cup and Handle Pattern

A lot of people can accumulate a stock during the formation of the cup itself, but this article is about the ‘Cup and Handle pattern’ and the trade is only taken after the entire formation is complete.

Before that, we wouldn’t even know it is a ‘Cup and Handle’.

Once you spot the pattern on the chart, you wait for a breakout which should be backed by higher volume.

The trade is taken above the cup and the stop-loss is the handle.

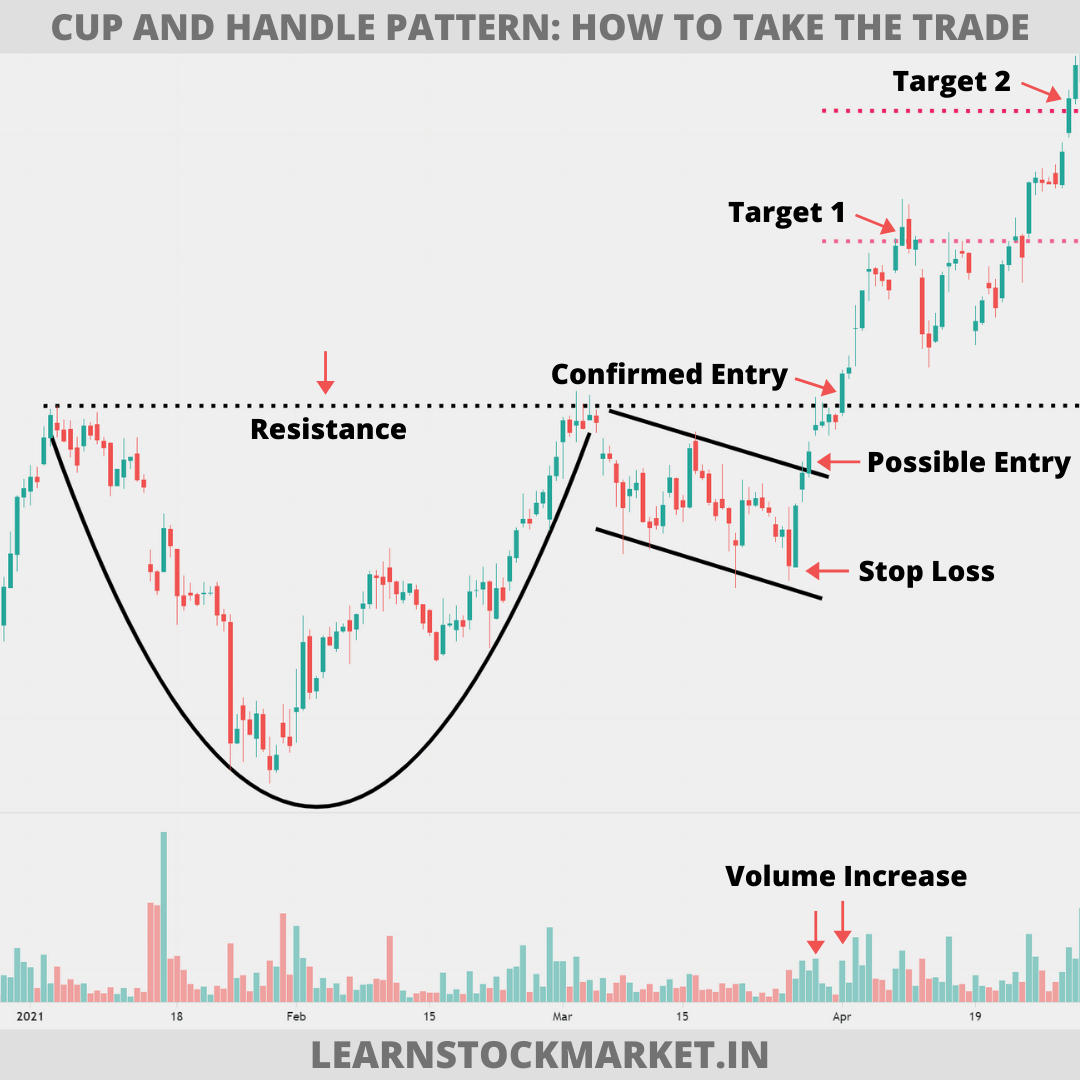

The image below should help you understand this a lot better.

Possible Entry: When the price breaks the trend-line of the handle, this can be a place where a ‘buy trade’ can be taken. This is a riskier trade, because the top of the cup can still act as a strong resistance.

Resistance: The top of the cup and handle pattern will act as a strong resistance. At this point, selling pressure can always come which can take the stock down again. Confirmation comes when the stock breaks the resistance with volume and starts to go higher.

Confirmed Entry: When the price breaks the top of the cup with volume, it is a sign that the stock is likely to rise further. Even though this is called a ‘confirmed entry’ point – always keep a stop loss – even when there is confirmation on the chart.

Target 1: The first target is the price range of the handle. The price from the top of the handle to the bottom – is how much it should move up. This is for short term trades.

Target 2: The second target is the size of the cup. The price drop from the top of the cup to the bottom. For example, if the price at the top of the cup is ₹ 100 and bottom of the cup is ₹ 80. The fall was ₹ 20. After the breakout, the stock should ideally move ₹ 20 – i.e. from ₹ 100 to ₹ 120.

Stop Loss: The first stop loss when taking the trade is the bottom of the handle. If the price breaks the ‘Cup and Handle’ resistance, it should not come down below the bottom of the handle. If it does, the trader should take a loss and exit the stock. Do remember, being disciplined and taking losses when the trade fails is very important.

Volume Increase: Notice how the volume spikes when the stock begins to break the handle formation. The volume increases for the second time when the stock breaks the cup and handle resistance.

Cup and Handle Pattern Trading Example

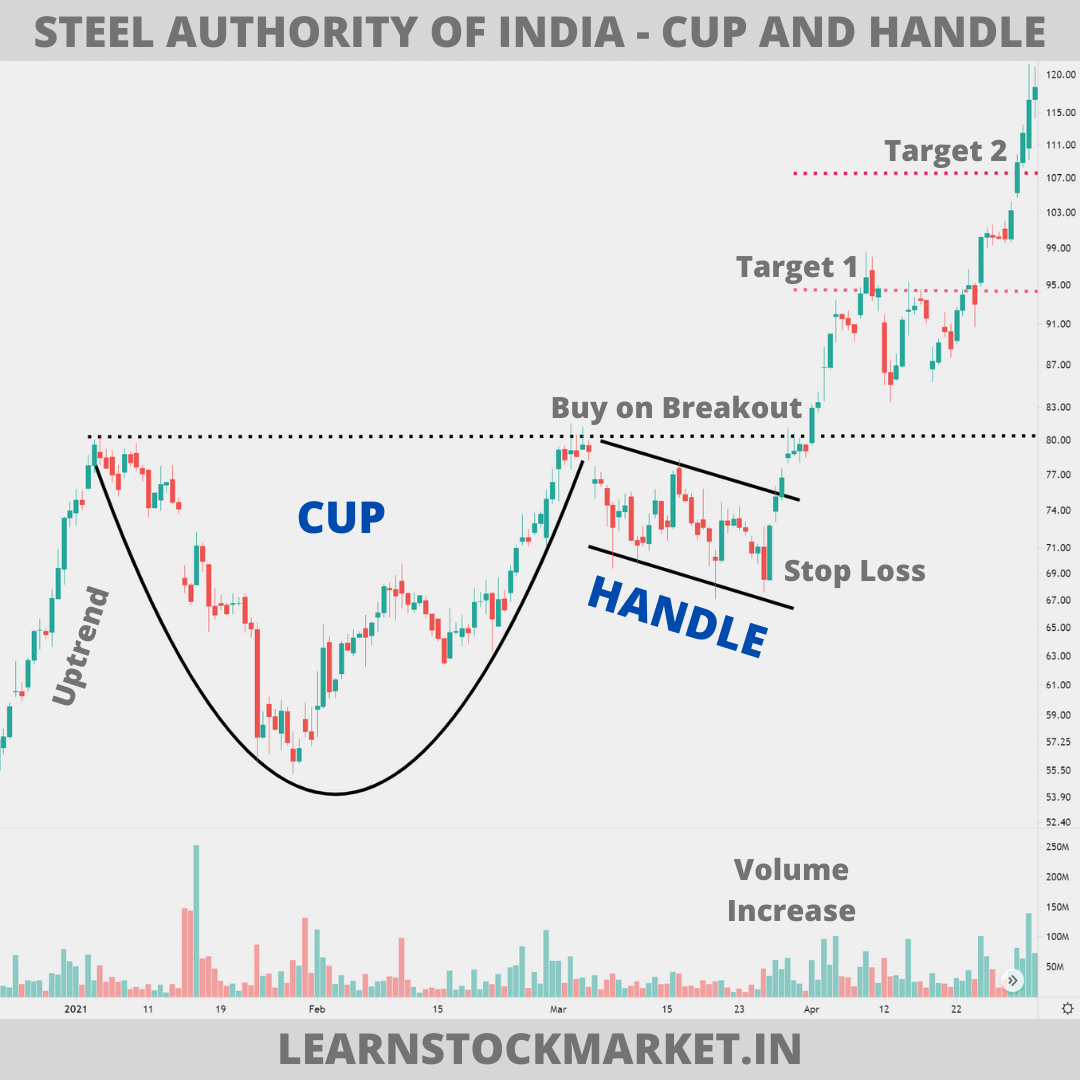

This is a real example of ‘Cup and Handle Pattern’ formation. A trade which made me quite a bit of money.

The name of the stock is ‘Steel Authority of India Limited’, also called as ‘SAIL’. Do note, names discussed here are for educational purposes only. We do not give stock recommendations. Every trade carries a risk of loss – more so if you are new to the market and do not understand what you are doing.

Back to the example. SAIL had created a beautiful cup and handle pattern.

This is how I traded the stock:

- The first time I bought SAIL was at around ₹ 76, when there was a breakout above the handle. It was backed by good volume as you can see in the image above.

- The stop loss was ₹ 68.

- The second transaction, with higher quantity purchase, was when the resistance of the entire pattern was broken on the upside. This was when the price was between ₹ 81-82. Again it was backed with good volume.

- From here, I kept a trailing stop loss and continued to ride (hold) the stock.

- After hitting the first target, the stock moved in the same range.

- After it broke the range, I kept the low of the range as the stop loss. It was around ₹ 85.

- I continued to hold it, till my stop loss was taken out at ₹ 126 on the 14th of May 2021.

Generally, I do not trade every ‘Cup and Handle Pattern’ that I see on the chart. It’s important to know why I decided to take a buying position in SAIL.

Here are some reasons (not all of them have been mentioned):

- The stock was in an uptrend. The first rule of ‘Cup and Handle pattern’ was fulfilled.

- The broader market sentiment was positive. Nifty has been in an uptrend for nearly a year between 2020-2021 and has shown no sign of weakness.

- Metals were in a strong uptrend too, it’s always good to look at the index a stock belongs to.

- SAIL belonged to the Nifty Metal index which is also called CNX Metal.

- I also looked at a few other indicators, which I use.

- Overall, the market was bullish. Metal index was bullish. SAIL was in an uptrend and was undergoing a correction, during which a ‘Cup and Handle’ was forming. All boxes ticked.

- The trade was taken. And just incase the trade still did not go my way, there was always a stop loss.

This is how trades should be planned and executed. Doing this increases the probability of the trade going in your favour.

If the market sentiment is weak, the chances of the trade working is much lower as compared to taking a position in a market uptrend.

Another important tip: If you find a cup and handle pattern on smaller time frames, check out the larger trend in higher time frames.

For example, if you find a cup and handle on 15-minute time frame, it makes sense to go higher to the daily time frame and check which way the stock has been moving.

If it looks bullish on 15-minute chart and it has been on a downtrend in the daily chart – then, ideally, you should not take the trade.

Chances of a trade going in your favour increases when you are taking a trade in the direction in which a stock is moving and not against it.

That’s about it for the article. We have covered the Cup and Handle pattern in extreme detail. If you still have any questions, post them in the comments section below.

Great work, keep on moving

its better than confusing youtube videos

Thank you very much for the detailed explanation. Would you mind please explaining me how to calculate the target 1 and target 2. The size of the cup even when I measure it, it is not the same between between the cup and handle resistance and the 2nd target.

Great work

Best Article.

Great explanation..