Tata Steel. Just two years ago, absolutely no one was interested in this cyclical company in the boring metal sector.

Now, everyone wants to buy shares of Tata Steel. And everyone loves the metal sector!

That’s the stock market for you. Things change and they change quickly. The quicker you get at catching the big trends, the more money we end up making. Those who are late, end up getting lower returns or get trapped right at the top.

Is the metal sector cyclical? It is. But that applies to every stock and the market itself goes through its own cycles of ups and downs. Some cycles are longer, some shorter.

There is no reason why ‘compounders’ like HDFC Bank or Asian Paints cannot go through a downcycle – but due to the opportunity size in a country like India, the cycles of these companies are so long that the upcycle itself can last several decades.

Metal sector has shorter cycles. That is the reason, stock in the metal sector are bought when the PE (Price to Earning) is high and sold when the PE is low.

In other words, buy when the earnings are low and the company is struggling. Sell when the earnings grow and the company begins to do well and prosper.

However, even though Tata Steel has been through several up and down cycles – those who have stayed invested for decades – have made decent returns, as long as they did not pick the worst time to buy shares of the company.

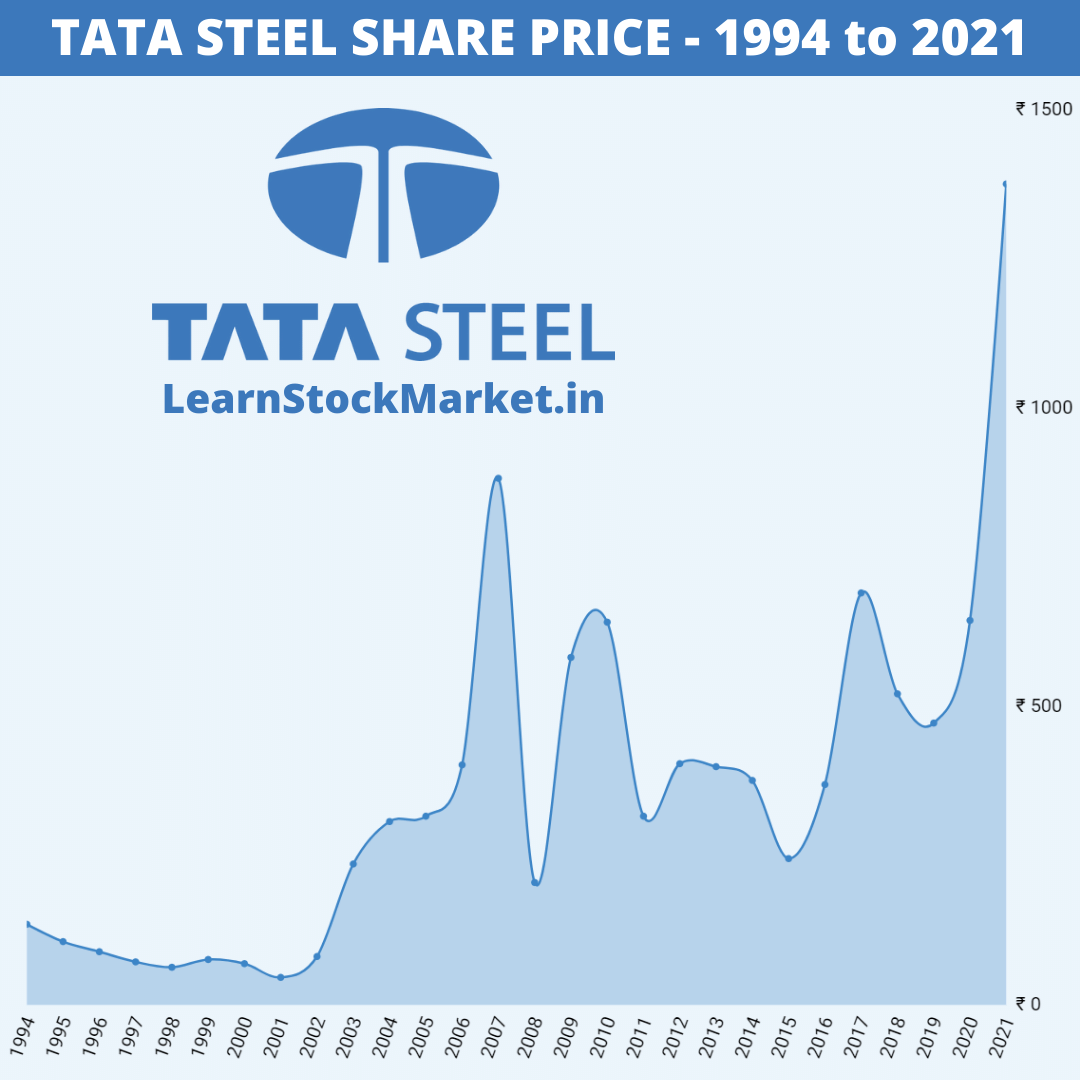

Tata Steel Share Price

The below image has the year-end share price of Tata Steel from the year 1994 to 2021. 27 years of data in one image!

The below table covers the share price of Tata Steel at the end of each year. The Rise / Fall column is the percent of rise or fall in the stock price from the previous year.

| Tata Steel | Price | Rise / Fall |

| 1994 Share Price | ₹ 135 | |

| 1995 Share Price | ₹ 106 | -21.5% |

| 1996 Share Price | ₹ 89 | -16.1% |

| 1997 Share Price | ₹ 72 | -19.1% |

| 1998 Share Price | ₹ 63 | -12.5% |

| 1999 Share Price | ₹ 76 | 20.6% |

| 2000 Share Price | ₹ 69 | -9.2% |

| 2001 Share Price | ₹ 46 | -33.3% |

| 2002 Share Price | ₹ 81 | 76.1% |

| 2003 Share Price | ₹ 236 | 191.4% |

| 2004 Share Price | ₹ 307 | 30.1% |

| 2005 Share Price | ₹ 316 | 2.9% |

| 2006 Share Price | ₹ 402 | 27.2% |

| 2007 Share Price | ₹ 882 | 119.4% |

| 2008 Share Price | ₹ 205 | -76.8% |

| 2009 Share Price | ₹ 582 | 183.9% |

| 2010 Share Price | ₹ 641 | 10.1% |

| 2011 Share Price | ₹ 316 | -50.7% |

| 2012 Share Price | ₹ 404 | 27.9% |

| 2013 Share Price | ₹ 399 | -1.2% |

| 2014 Share Price | ₹ 376 | -5.8% |

| 2015 Share Price | ₹ 245 | -34.8% |

| 2016 Share Price | ₹ 369 | 50.6% |

| 2017 Share Price | ₹ 690 | 86.9% |

| 2018 Share Price | ₹ 521 | -24.5% |

| 2019 Share Price | ₹ 472 | -9.4% |

| 2020 Share Price | ₹ 644 | 36.4% |

| 2021 Share Price | ₹ 1375 | 113.5% |

As you can see from the table above and the image, the performance of the stock has been very inconsistent.

A couple of years of outstanding returns, followed by a sudden crash in value.

In the last 25 years, four years Tata Steel has doubled your investment within a single year. 2003, 2007, 2009 and this year 2021.

At the same time, crashes have been quite frequent too. Four years out of the last 25, the stock has crashed more than 30%. In 2008, Tata Steel lost almost 80% of its value.

Almost all the returns it gave during its best period – in the bull market of 2003 to 2007 – was taken back by the market crash in 2008.

There are two important points to be noted here:

- When you buy a company which has short, but strong cycles like Tata Steel – you have to get the entry and exit right. These are not companies which you can buy and hold it in your portfolio forever. Always have a ‘stop loss’ and trail it as the stock rises.

- Do not allocate a large percentage of your portfolio into such companies. It is always better not to allocate more than 5% to such stocks and a maximum of 20% to one sector – even if you are extremely bullish on the sector. This is because the performance (or non-performance) depends on various global factors which are beyond your control.

There is risk involved, but that does not mean you should entirely avoid highly cyclical companies like Tata Steel, JSW Steel or Hindalco.

This is because, when they turnaround – big money can be made in a relatively shorter period of time. In the stock market – it is always better to not have any biases.

The goal is to make money (we tend to forget this as we gain more knowledge in the stock market) and grow the value of the portfolio – by taking calculated risks. An investor’s mind should be open to change. This is the only way to catch large trends.

Tata Steel Share Returns

How much returns has Tata Steel given in the last 1 or 2 years? What about 3, 5, 10, 20 years?

Check out the table below:

| CAGR | Absolute Returns | |

| 1 year | 113.51% | 2.14 times |

| 2 years | 70.68% | 2.91 times |

| 3 years | 38.19% | 3.84 times |

| 4 years | 18.81% | 2.90 times |

| 5 years | 30.09% | 5.42 times |

| 10 years | 15.84% | 6.33 times |

| 15 years | 8.54% | 4.98 times |

| 20 years | 18.52% | 43.48 times |

| 25 years | 14.67% | 22.47 times |

Unless you picked the absolute wrong time, Tata Steel has given very good returns – even over a long period of time.

The last two years have been exceptionally good, as a new metal cycle has begun after the Covid crash and the rise in commodity prices.

The returns when calculated over a 15 year period looks poor, but that is only because it coincides with the peak of the 2008 bull run.

1 Lakh invested in Tata Steel

If you had invested 1 lakh in ‘Tata Steel’, how much returns has it given over different time periods?

The table below has the figures:

| 1 Lakh Invested | |

| 1 year | 2,13,509 |

| 2 years | 2,91,314 |

| 3 years | 3,83,877 |

| 4 years | 2,89,855 |

| 5 years | 5,42,005 |

| 10 years | 6,32,911 |

| 15 years | 4,97,512 |

| 20 years | 43,47,826 |

| 25 years | 22,47,191 |

An investment of 1 lakh, 5 years ago, would be valued at ₹ 5.42 lakhs today. The same investment made 15 years ago, would be worth nearly 4.97 lakhs today.

This clearly shows, if you do not enter and exit companies like Tata Steel at the right time – it is very difficult for you to make money. Timing is important.

If you become a long term investor and hold the stock ‘forever’ – chances are you may not make money. And even if you do, you could see your stock rise 5 times and then fall 50-60% – before it rises back again. This will make the investment journey painful. And when investing becomes a painful and frustrating experience, you eventually end up selling the stock at the wrong time.

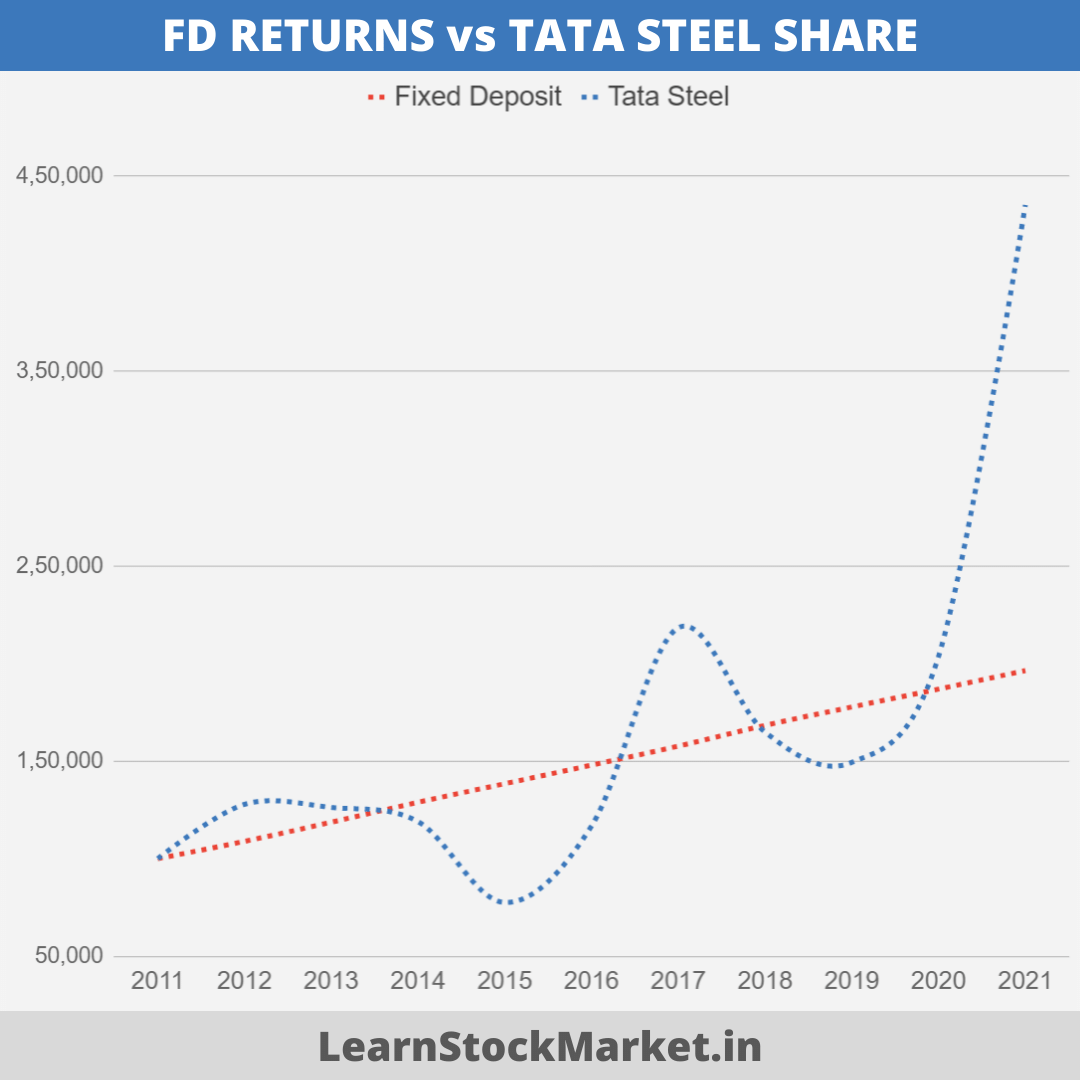

Tata Steel vs FD Returns

What if you opened a fixed deposit of 1 lakh in a bank and made another investment of 1 lakh in Tata Steel Shares. For the sake of comparison, let us assume both investments were made in the year 2011 (i.e. 10 years ago).

The results are below.

| Fixed Deposit | Tata Steel | |

| 2011 | 1,00,000 | 1,00,000 |

| 2012 | 1,08,880 | 1,27,848 |

| 2013 | 1,18,679 | 1,26,266 |

| 2014 | 1,28,921 | 1,18,987 |

| 2015 | 1,38,436 | 77,532 |

| 2016 | 1,47,960 | 1,16,772 |

| 2017 | 1,57,696 | 2,18,354 |

| 2018 | 1,68,340 | 1,64,873 |

| 2019 | 1,77,767 | 1,49,367 |

| 2020 | 1,86,958 | 2,03,797 |

| 2021 | 1,96,418 | 4,35,127 |

| Returns | 6.98 | 15.84% |

Note: FD interest rates have been adjusted each year, as per data taken from Reserve Bank of India (RBI). The average FD rate over last 10 years has been around 7%. The interest rates are lower at the time of writing this article, but it was higher in 2011.

Some points:

- After analyzing the stock price history of several companies, one thing is clear – over a long period of time, most (good) companies have ended up giving better returns than a fixed deposit.

- The big difference is the volatility and patience. FD is not volatile and because we know exactly how much returns we will get after a 5 / 10 year period – patience does not become a factor.

- Stock Market is a different ball game altogether. Let us try to understand the emotions an investor would go through when he invests in a company like Tata Steel. (Refer to the FD vs Tata Steel image below as you read the next few points.)

- Assuming you invested in Tata Steel in 2011 (10 years ago), immediately after your entry the stock was beating returns from FD.

- About a year later, the fall starts and continues. In your 2nd and 3rd year you get no gains. The 4th year becomes the most painful as the value of your investment crashes. It is at this time that most people end up selling their investment.

- It’s also at this time when the pain is at its highest that the stock has very few buyers and every rise gets sold into. This is the period can also be called ‘bottoming out’ or the phase when there is ‘accumulation’ happening.

- Smarter investors are buying shares of the company as weaker investors / traders exit.

- If you stayed invested, the uptrend begins. Within a year, you have covered most of your losses and the stock returns once again starts outperforming your investment in a fixed deposit.

- In the 7th year, the stock begins its downtrend once again. It’s at this time that even those investors who held with patience in the first fall are tested again.

- When you compare your returns in the 8th year, you realize you have unnecessarily endured the pain of volatility for 8 long years – when a comfortable investment in FD has given better returns. Risk free.

- This is why long-term investing is difficult. It is easy to hold a company when it is rising. It is easy to hold a company which is already in loss. But it is very difficult to see big gains, after which you decide to stay-invested – only to see all your gains vanish once again.

- If you lose your patience and exit here, you would have ended up selling Tata Steel at a time when it was about to rise more than 3 times in one of the fastest bull markets the Indian stock market has seen.

- If you bought in 2011 and held till 2021 – it would have been a ride full of difficulties, but the returns from the last year ensured Tata Steel outperformed FD massively.

- If you can avoid buying when everyone is buying the same stock and avoid selling when everyone is selling – there is no reason why you can’t make money even in cyclical companies like Tata Steel.

If you have any questions, you can ask them in the comments section below.

Leave a Comment