If a list is made of the most successful companies in the history of Independent India, Asian Paints would find a place in the Top 10.

Such is the dominance of this company in the ‘paint industry’, that 40% of all paints sold across the country is Asian Paints.

When a company becomes as successful as Asian Paints, the rewards for shareholders would be unbelievably good too.

Did you know – 1 lakh invested in Asian Paints in 1990 would be worth more than 9 crore today?

Read the article till the end, as we cover the journey of the iconic paint company from 1990 to 2021.

Asian Paints Share Price History

In the table below, the Asian Paints Share Price on the last day of every year has been mentioned.

At the end of 1990, the share price of Asian Paints was ₹ 3 per share. The price has been adjusted for ‘bonus shares’ and ‘share splits’ over the years.

| Asian Paints | Share Price | Rise / Fall |

| 1990 | ₹ 3 | |

| 1991 | ₹ 4 | 33.33% |

| 1992 | ₹ 6.1 | 52.50% |

| 1993 | ₹ 8.6 | 40.98% |

| 1994 | ₹ 11 | 27.91% |

| 1995 | ₹ 13.1 | 19.09% |

| 1996 | ₹ 12.3 | -6.11% |

| 1997 | ₹ 12.5 | 1.63% |

| 1998 | ₹ 11.8 | -5.60% |

| 1999 | ₹ 15.4 | 30.51% |

| 2000 | ₹ 18.4 | 19.48% |

| 2001 | ₹ 18.1 | -1.63% |

| 2002 | ₹ 21.6 | 19.34% |

| 2003 | ₹ 33.6 | 55.56% |

| 2004 | ₹ 32 | -4.76% |

| 2005 | ₹ 57.6 | 80.00% |

| 2006 | ₹ 73.2 | 27.08% |

| 2007 | ₹ 110 | 50.27% |

| 2008 | ₹ 89.4 | -18.73% |

| 2009 | ₹ 179.3 | 100.56% |

| 2010 | ₹ 287 | 60.07% |

| 2011 | ₹ 298 | 3.83% |

| 2012 | ₹ 441 | 47.99% |

| 2013 | ₹ 490 | 11.11% |

| 2014 | ₹ 750 | 53.06% |

| 2015 | ₹ 882 | 17.60% |

| 2016 | ₹ 890 | 0.91% |

| 2017 | ₹ 1158 | 30.11% |

| 2018 | ₹ 1374 | 18.65% |

| 2019 | ₹ 1787 | 30.06% |

| 2020 | ₹ 2764 | 54.67% |

| 2021 | ₹ 2410 | -12.81% |

One thing that really stands out from the share price history of Asian Paints is the consistency with which the company and its stock has performed over the last 30 years.

- The ‘year-end’ returns have been negative only 5 out of the last 30 years.

- The stock has never ended the year in negative in the last 12 years.

The share price is down in 2021, but the year is yet to end. At the time of writing this article, we still have 10 more months to go in the year 2021.

What’s even more significant is the performance of Asian Paints in bear markets. In 2008, when most stocks crashed by 50-90%, Asian Paints held reasonably well throughout the year. It fell in the beginning of 2009, but recovered quickly.

In the Corona-virus crash in 2020, Asian Paints once again sustained better than several other companies.

This was the past. The future could be better for several reasons:

- India is still a developing country. The demand for paints is expected to increase in the future.

- The company has a distribution network of over 70,000 distributors spread across the country – more than any other paint company in India.

- Asian Paints has diversified into home improvement business – the ‘Sleek’ brand provides customised kitchens and wardrobes. Brands like ‘Essess’ and ‘BathSense’ offer bath-fittings and accessories.

- These brands are designed to take advantage of the large distribution network of the company.

Asian Paints Share Returns: Compounded and Absolute

How much returns has Asian Paints given if you bought the share 2 years ago? Or 5, 10, 30 years ago.

Check out the table below.

| CAGR | Absolute | |

| 2 years | 41.83% | 2.01 |

| 3 years | 33.64% | 2.39 |

| 4 years | 32.75% | 3.11 |

| 5 years | 25.66% | 3.13 |

| 10 years | 25.42% | 9.63 |

| 15 years | 29.44% | 47.99 |

| 20 years | 28.48% | 150.22 |

| 25 years | 23.87% | 210.99 |

| 30 years | 25.55% | 921.33 |

These numbers are simply outstanding. Asian Paints has compounded at a staggering rate of 24-30% in the long term (above 5 years).

If you invested in Asian Paints 30 years ago and continued to hold the stock today, 1 rupee would convert into 921 rupees!

Where other than the stock market would you get such returns? This also shows the power of compounding and the life-changing journey of long term investment.

The returns do not include dividends, which the company has been consistently paying out over the last couple of decades.

The dividend isn’t a lot (the current dividend yield is just 0.5%), but the company has plenty of scope for growth in a country like India. Instead of paying dividends, the profits the company is making is being re-invested back into the business.

Which brings us to the next question…

1 lakh invested in Asian Paints

Suppose you invested 1 lakh rupees in Asian Paints, how much would it be over different time periods?

The answer is in the table below:

| Time Period | 1 Lakh Investment |

| 2 years | 2.01 lakhs |

| 3 years | 2.39 lakhs |

| 4 years | 3.10 lakhs |

| 5 years | 3.13 lakhs |

| 10 years | 9.63 lakhs |

| 15 years | 47.99 lakhs |

| 20 years | 1.50 crore |

| 25 years | 2.11 crore |

| 30 years | 9.21 crore |

Again, the returns are extraordinary. Over a 10 year period, 1 lakh invested would’ve grown to 9.63 lakhs. In 15 years, nearly 48lakhs i.e. 48x returns.

If some of those old investors are still lucky and patient enough to hold Asian Paints over a 25-30 year period, the stock would’ve made their life – in terms of wealth.

What this shows is – one quality compounder, held over a prolonged period of time, can generate immense amount of wealth. You do not need to be constantly in search of new companies to invest in.

Pick a few industry leaders across sectors, give a decent allocation, hold it through market ups and downs – a few could repeat the success of Asian Paints over the next 30 years.

In fact, there is no reason why Asian Paints itself cannot give extraordinary returns in the future.

Do note: The entire article is strictly for learning purpose only. We do not recommend stocks. Kindly consult your financial advisor.

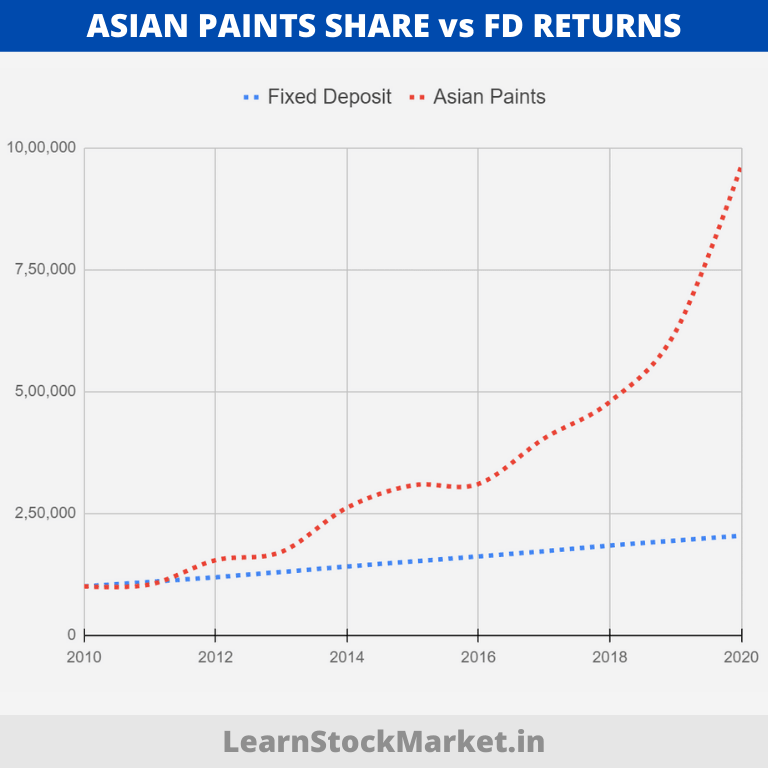

Asian Paints Share vs FD Returns

What if you opened a fixed deposit of 1 lakh with a bank and made another investment of 1 lakh in Asian Paints?

The results are below. Again, the returns from Asian Paints does not include dividends.

Note: The Fixed Deposit interest rate for each year has been taken from the ‘Reserve Bank Of India’ website. Those numbers have been used for calculation.

Some points to be noted:

- Notice the two lines in the graph above. One moves in a straight predictable line, the other is unpredictable.

- Yet, Asian Paints has been far more predictable and comfortable to hold than many other stocks.

- Also, there has never been a bad time to invest in Asian Paints. If bought in corrections, the stock has always given good returns to investors – if the investment duration is 5 years or more.

- However, that does not mean, the stock will give such returns in the next 10 years too. Companies like Asian Paints always look expensive, which is one of the reasons why getting a comfortable entry point into such stocks is difficult.

- If you invested in 2010 in Asian Paints, for the first year and a half, the returns would be very similar to FD interest.

- It’s from 2013 when you would’ve started seeing huge gains.

- The 2015 to 2017 period was also relatively dull for Asian Paints – this was the time when several mid and small cap companies were giving 100-200-300% returns.

- After 2017, while several lesser companies crashed out, Asian Paints gave phenomenal returns to investors.

- Over a period of 10 years, the value of your Asian Paints investment would be 5 times more than the value of your fixed deposit. That, in short, is the power of the stock market.

What are your thoughts on Asian Paints? What kind of returns do you think the company will give in the future? Let us know in the comments section below.

Do a similar 30 yr analysis for Berger paints , Nestle, PI industries

Great analysis.

I look forward to a similar analysis on its closet competitor

Berger paints