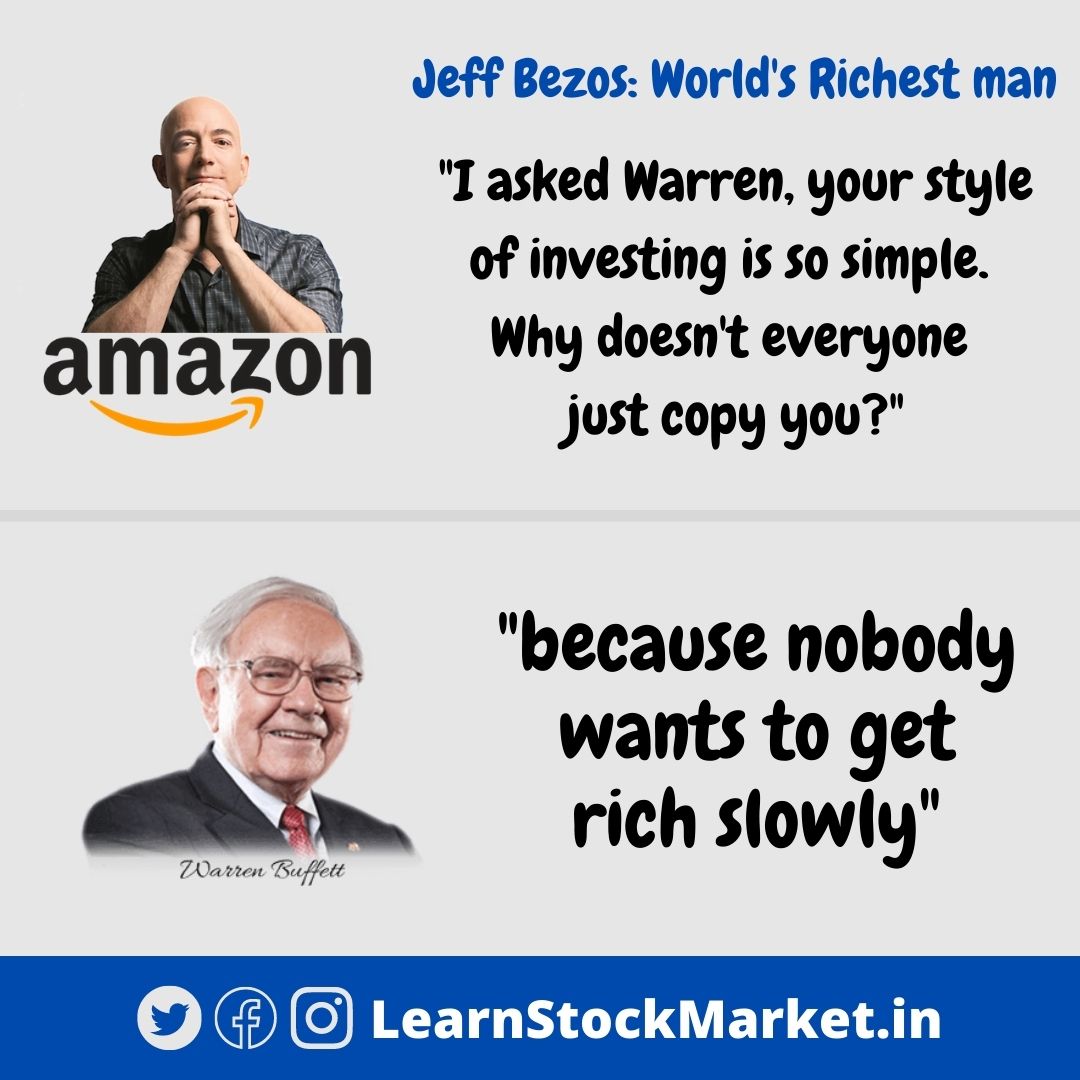

There was an interesting quote which I stumbled upon recently.

The world’s richest man and the founder of Amazon, Jeff Bezos, was once asked about the best advice Warren Buffett has given him.

Buffett, as we all know, is one of the richest in the world. But it’s not his wealth that stands out.

Buffett started investing at the age of 11 and continues to be at the top of his game at the age of 90.

The miracle here is – starting at a very early age and continuing well beyond the age of retirement.

99.7% of Buffett’s wealth was earned after the age of 52.

In other words, more the number of years, the better – as compounding begins to show its power with time.

Most beginners who enter the market, come with a desire to make money quickly.

If you give someone an investment plan of doubling money in 5 years, they would simply not be interested.

It’s normal for people to have expectations of doubling their money within 1 or 2 months.

Those are the kind of expectations with which people enter the market – even though the same person would be comfortable in keeping the same money in a bank fixed deposit, which takes 11-12 years to double!

But in the stock market, we want to double our money within months – if not weeks!

This is exactly the kind of mindset which makes us invest in small and lesser known companies.

Think about it. A stock like Reliance Industries or TCS will move very slowly. Some days it might go up or down by 1%, on other days it might be flat. Only a few days in a year the price will show significant movement.

It might give significantly better returns than other asset classes, but it is boring.

Such stocks are not liked by the masses. The general tendency is to buy ‘Yes Bank’ or ‘Vodafone Idea’ – which are penny stocks (costing less than 20 rupees per share).

The belief is, a share costing 2000 cannot double. Whereas Vodafone Idea could go from 10 rupees to 50 rupees easily and your investment can go up 5 times.

This is what new investors truly believe and this ends up costing them a lot – especially in a bear market where lower quality stocks could crash by 80-90% or more.

Capital protection and managing your risk is more important than trying to make money in the stock market. You need to bet on quality companies with growth potential in a country like India.

Understand the business, it’s story and future potential. Only then invest your hard earned money.

This applies for business or anything in life too. Slow compounding gives its benefits in many things.

Amazon started its business with a long term mindset. Go read about it. Their vision has always been long term. Same with most other successful companies.

If you are unfit and want to have a great physique. Most fail because they go to the gym for a few weeks – expect great results, don’t get it and quit.

Instead, forget about the results and just go to the gym for one full year. You don’t have to lift big weights or go anything extreme. Slowly, steadily and consistently. Small steps every single day.

The results will compound and you will be surprised as to how far you have reached after a year.

The same applies to investing. Have a long term mindset. No one can stop you from being successful.

Thank you