There are two major stock exchanges in India. Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).

Most of us know this.

But do you know there are other stock exchanges too?

Did you know there were 20+ stock exchanges in India which were permanently shut down?

This article will have interesting information on old stock exchanges in India as well as the ones that are open today.

Make sure you read the article till the end. It’s worth spending 5 minutes for new and interesting information.

- Stock Exchanges in India 2021

- Bombay Stock Exchange (BSE)

- National Stock Exchange of India (NSE)

- Calcutta Stock Exchange

- Metropolitan Stock Exchange of India

- India International Exchange (India INX)

- NSE International Exchange (NSE IFSC)

- National Commodity & Derivatives Exchange

- Multi Commodity Exchange of India (MCX)

- Indian Commodity Exchange (ICEX)

- Old Stock Exchanges in India

Stock Exchanges in India 2021

These are the stock exchanges in India that are active as on 18th April 2021:

| Name | Location |

| Bombay Stock Exchange | Mumbai |

| Calcutta Stock Exchange | Kolkata |

| India International Exchange (India INX) | Gandhinagar |

| Indian Commodity Exchange | Navi Mumbai |

| Metropolitan Stock Exchange of India | Mumbai |

| Multi Commodity Exchange of India | Mumbai |

| National Commodity & Derivatives Exchange | Mumbai |

| National Stock Exchange of India | Mumbai |

| NSE IFSC | Gandhinagar |

Bombay Stock Exchange (BSE)

Since BSE has a beautiful history, we’ll get into a little more detail while discussing this stock exchange.

Established in 1875, the Bombay Stock Exchange is not only the oldest stock exchange in India, but is also the oldest stock exchange in the entire continent of Asia.

The market capitalisation of all companies listed in the BSE is $2.2 trillion – making it the 10th largest in the world.

BSE has an interesting history.

More than 160 years ago, in the 1850s, five stock brokers first gathered together under a Banyan tree.

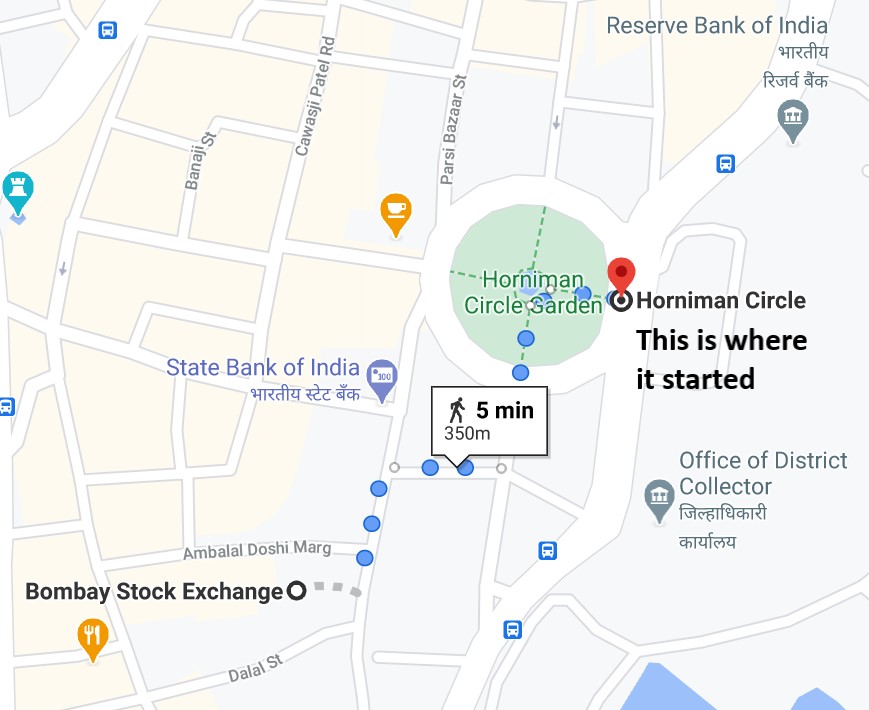

In 1850s, five stock brokers gathered under a Banyan tree in front of Mumbai Town Hall. The place where the Horniman Circle is now situated.

This is where it all began:

A few years later, the brokers to the junction of Meadows Street – which was previously called Esplanade Road (Now M.G Road).

With the increase in number of brokers, they had to shift places quite frequently. Finally, in 1874, the brokers found a permanent location. The new place was called ‘Dalal Street’ which in English means Brokers street.

The group became an official organisation called ‘The Native Share & Stock Brokers Association’ in 1875.

Many years later, this very organisation went on to be called as ‘Bombay Stock Exchange’. It was also the first stock exchange to be officially recognised by the Indian government.

1986: BSE launched Sensex, the first index in India which was used to measure the overall performance of the stock market.

During those years, trading would take place in an open floor using the ‘outcry’ system.

In 1995, BSE shifted to its electronic trading system – which is currently in use today.

Let’s move to the next stock exchange in India.

National Stock Exchange of India (NSE)

A stock exchange that revolutionised the way the country bought and sold shares.

Established in 1992, the National Stock Exchange (NSE) was the first to provide a modern, fully automated screen-based electronic trading system.

Imagine the impact.

Suddenly, people in every part of the country and all across the world, could easily trade from anywhere.

Stock price information which could earlier be accessed only by a few influential people, could now be seen by anyone from anywhere.

Transparency, ease and reach – were all achieved and the result was spectacular.

Today, the NSE is far ahead of BSE in terms of volume and turnover.

Visit the stock page of any company on Moneycontrol or any other website and check the ‘Volume’ column. NSE usually has 10-20 times more volume of shares traded than BSE.

When the NSE was started, it could handle 2 orders per second. In the year 2001, it could handle upto 60 orders per second. Now, it can handle more than 1,60,000 orders per second!

The system has become faster, efficient, more secure and completely cashless.

The company is likely to be listed on the stock exchange soon. The hype around the IPO will be immense.

Calcutta Stock Exchange

It all started under a ‘neem tree’ in 1830, when a bunch of brokers first started their dealings.

The CSE was first incorporated in the year 1908. It was called ‘Calcutta Stock Exchange Association’ and the location was at 2, China Bazar Street, Kolkata. The present building at Lyons Range (Kolkata) was constructed in 1928.

The CSE followed the ‘floor outcry’ system until 1997, when it started using an electronic trading system.

Interestingly, the BSE holds 5% stake in CSE.

The Calcutta Stock Exchange also has an index called ‘CSE 40’ – which is similar to Sensex and Nifty 50. It stopped updated its index from April 2013.

Trading no longer takes place in CSE, even though it’s considered to be a permanent stock exchange.

Along with several other small stock exchanges, the SEBI had also asked the Calcutta Stock Exchange to exit. The matter is currently in court. Until the court gives its verdict, the CSE will be considered an active stock exchange – even though it’s inactive.

Metropolitan Stock Exchange of India

The Metropolitan Stock Exchange of India (MSEI) is one of only 3 stock exchanges in India – where individual stocks can be traded. The other two, quite obviously, are BSE and NSE.

At the time of writing this article, 1798 companies were allowed to trade on the MSEI. You can check the full updated list on this link.

The company was formed in November 2008 and it started its operations in February 2009.

The MSEI is full-service national level Stock Exchange with a license to operate in Equity, Equity Derivatives, Currency Derivatives, Debt and SME Platform.

India International Exchange (India INX)

The India INX is not a regular stock exchange where individual stocks are traded. Derivatives and debt are the segments it functions in.

Inaugurated in January 2017 by Prime Minister Narendra Modi, the India INX is the world’s fastest exchange. It operates on the Eurex T7 platform, which is one of the most advanced technology platforms in the world.

Since India INX targets international investors – it operates for 22 hours a day and is open for 6 days in a week. This timing is convenient for non-resident Indians and global investors who work under different time zones.

The India INX was founded by the Bombay Stock Exchange.

NSE International Exchange (NSE IFSC)

The NSE IFSC is very similar to the India INX. It caters to international investors and the NRI community.

It was established in November 2016 and has its headquarters in Gandhinagar, Gujarat.

The NSE IFSC does not trade individual stocks. It’s allowed to trade in the derivative segment (future and options) – which includes equity, commodity and currency.

The NSE IFSC is open for nearly 16 hours. The first session is between 8AM to 5PM. The second session is between 5:02PM to 11:30PM.

National Commodity & Derivatives Exchange

The NCDEX is only permitted to trade in the Commodity Derivatives segment. This means you will see everything from Turmeric, Soy Bean, Refined Oils, Wheat, Channa and various other types of seeds that are actively traded here.

The NCDEX was established in the year 2003 in Mumbai. It’s said to have a client base of more than 30 lakhs – who trade on more than 50,000 terminals across 1000 centers in India.

Multi Commodity Exchange of India (MCX)

MCX is the largest commodity derivatives exchange in India. It’s headquarters are in Mumbai.

Companies are not traded on the Multi Commodity Exchange. Trading takes place in Gold, Silver, other metals, crude oil, natural gas and agricultural items – like cardamon, pepper, crude palm oil, rubber, cotton etc.

The stock of MCX is listed on NSE and BSE.

Indian Commodity Exchange (ICEX)

Again, ICEX is not a ‘stock exchange’ as such. It’s a commodity exchange which trades commodity derivates.

The ICEX got approval for trading operations in July 2017. They were the first to launch ‘Diamond Futures’ contract in August 2017.

A year later in August 2018, they launched India’s first ‘Steel Futures’ contract. Later that year, the NMCE (India’s oldest commodity exchange) merged with ICEX.

Those are the active stock exchanges in India. Out of those, only three – BSE, NSE and MSEI are allowed to trade in the equity cash segment. The rest are into commodity and derivatives.

Out of these, the three most popular exchanges are NSE, BSE and MCX.

Old Stock Exchanges in India

You should also know, there were more than 20 other stock exchanges in India. A few of them have a fascinating history.

We’ll cover all of them here. Go ahead and read it if you want to know about the history of stock exchanges in India.

Ahmedabad Stock Exchange

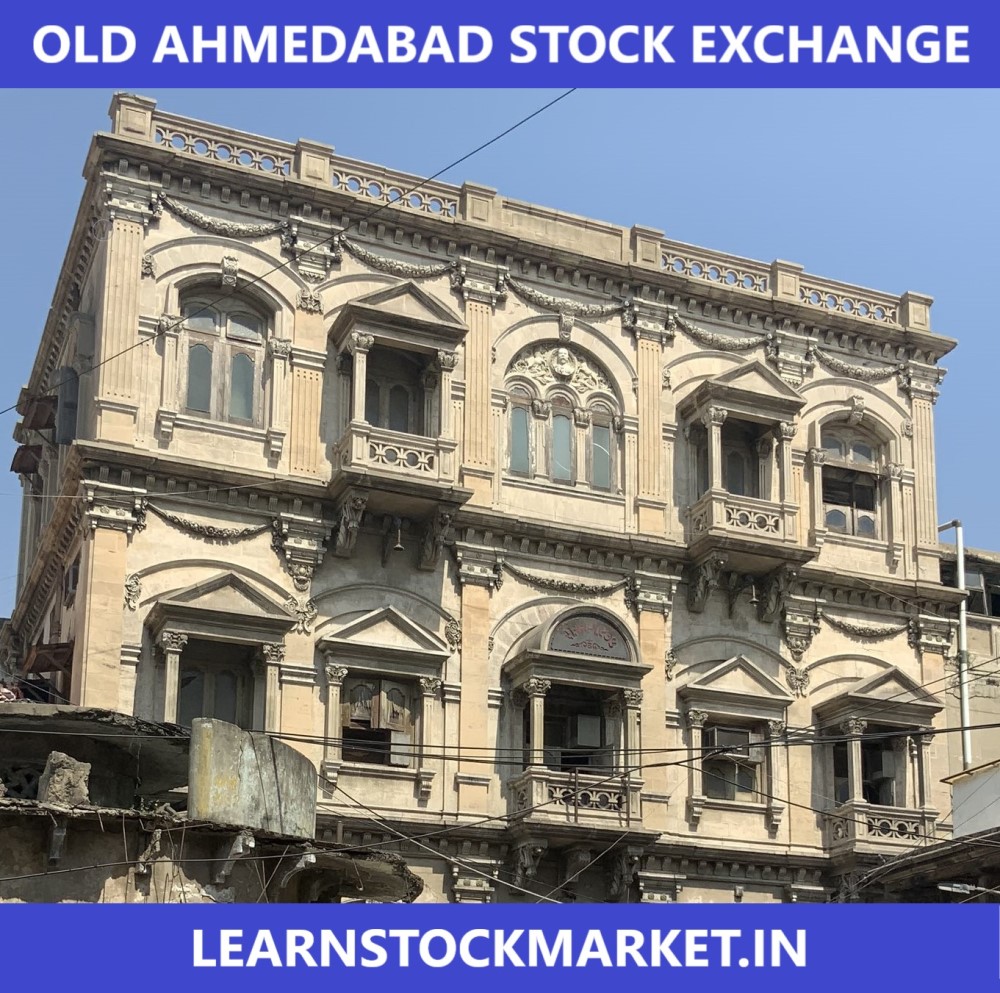

The Ahmedabad Stock Exchange (ASE) is the second oldest stock exchange in India, after the Bombay Stock Exchange.

For more than 90 years, the exchanged functioned under the old heritage building – right till the year 1996.

The old heritage building is now called ‘Old Stock Exchange’. Here is how it looks now:

In 1996, ASE moved to a new building. In the same year, they went completely electronic in a system provided by IBM.

However, SEBI decided to close regional stock exchanges with net worth of less than 100 crore and turnover of less than 1000 crore. This move led to the permanent closure of ASE in April 2018.

Delhi Stock Exchange

First established on 25th June 1947, the Delhi Stock Exchange (DSE) was the 5th stock exchange in India.

It was a fairly large stock exchange with more than 3000 listed companies. Its terminals were well connected with major cities.

The SEBI allowed the DSE to exit the stock exchange business in January 2017.

Gauhati Stock Exchange

Also known as Guwahati Stock Exchange, it was established on 29th November 1983. The GSE was well-connected with NSE and its members were allowed to do screen-based trading.

The GSE had 290 listed companies before it was allowed to exit the stock exchange business in January 2015.

Jaipur Stock Exchange

At one point of time, in terms of membership, the Jaipur Stock Exchange (JSE) was the third largest in India. It was established in 1989.

There were more than 750 companies listed on the JSE and the average turnover was more than ₹ 8 crore per day – before it accepted SEBI’s guidelines and closed down its business in March 2015.

Madhya Pradesh Stock Exchange

The Madhya Pradesh Stock Exchange (MPSE) was the 3rd oldest stock exchange in India. It was also said to be one of the leading exchanges during the time of ‘floor outcry system’.

The MPSE was established in 1919. During its peak, MPSE had nearly 320 companies listed on its exchange.

After partnering with NSE and BSE, MPSE became the only regional stock exchange in India to provide independent trading platform for its members.

In 2014, SEBI asked MPSE to create its own trading platform with a net worth of ₹ 100 crore. When it failed to do so, the SEBI de-recognized MPSE in 2015.

Pune Stock Exchange

Way back in September 1982, the central government of India granted recognition to the Pune Stock Exchange (PSE) for a period of 5 years. The membership was renewed from time to time.

When SEBI norms required stock exchanges to have annual trading turnover of ₹ 1000 crore – the PSE was doing much less.

The PSE decided to voluntarily exit the stock exchange business in April 2015.

Mangalore Stock Exchange

Established way back in 1984, the Mangalore Stock Exchange (MGSE) was officially recognised by the government in September 1985.

After multiple renewals, the last recognition was valid till September 2003.

In August 2004, SEBI decided to de-recognise the Mangalore Stock Exchange. This was after the Chief Minister of Karnataka had laid foundation stone for a new building in September 2001.

Vadodara Stock Exchange

The Vadodara Stock Exchange (VSE) first began its operations in the year 1990. It had recognition as a permanent stock exchange.

Again, it was the annual turnover ruling of ₹ 1000 crore turnover by SEBI – which resulted in the shutting down of the VSE in 2015.

Uttar Pradesh Stock Exchange

The UP Stock Exchange (UPSE) was inaugurated by formed President of India, the late Pranab Mukherjee, in August 1982.

It was a major stock exchange in North India, with more than 550 members.

Since internet didn’t exist back then, the UPSE was instrumental in increasing the interest in capital market in the state of Uttar Pradesh.

SEBI allowed the UPSE to exit the stock exchange business in 2015.

Bangalore Stock Exchange

The Bangalore Stock Exchange (BGSE) was established in the year 1963. It was a popular stock exchange, before it decided to exit the stock exchange business in 2014 due to the SEBI order.

Madras Stock Exchange

Just like all other exchanges, the Madras Stock Exchange (MSE) also had to shut down due to the SEBI ruling.

MSE was the fourth stock exchange in India, it was founded in the year 1937.

It was large exchange with nearly 1800 listed companies.

Cochin Stock Exchange

Another stock exchange which fell because of low turnover. The Cochin Stock Exchange (CSE) was the fourth largest in the country during its peak.

Yet, the difference between the Top 2 (NSE, BSE) and the others was just too large.

The CSE closed its trading operations in 2005 and completely shut down the stock exchange in 2014.

The other stock exchanges in India that were shut down due to the SEBI ruling are:

- Ludhiana Stock Exchange

- Bhubaneshwar Stock Exchange

- Coimbatore Stock Exchange

- Hyderabad Stock Exchange

- Magadh Stock Exchange

- Trivandrum Stock Exchange

That’s the end to the article on ‘Stock Exchanges in India’. We hope you learnt something new. If you have any questions, post a comment below.

Last Updated: 18th April 2021.

Hi I went through numerology for stocks.

What should be input as name? should it be full name of me , fathers name and surname too?

Where can i get chaldean number wise stock list or pythogorean number wise.