Let us go back in time. The year was 1999 and internet was very different from how it is today.

Most Indians did not have an internet connection and for those who did – the internet was about 1600 times slower than a 100 Mbps connection today.

It was also very costly!

The potential of internet was huge, and the expectations that internet is going to be the future of the world – led to a serious global bull market, which was dominated by internet companies.

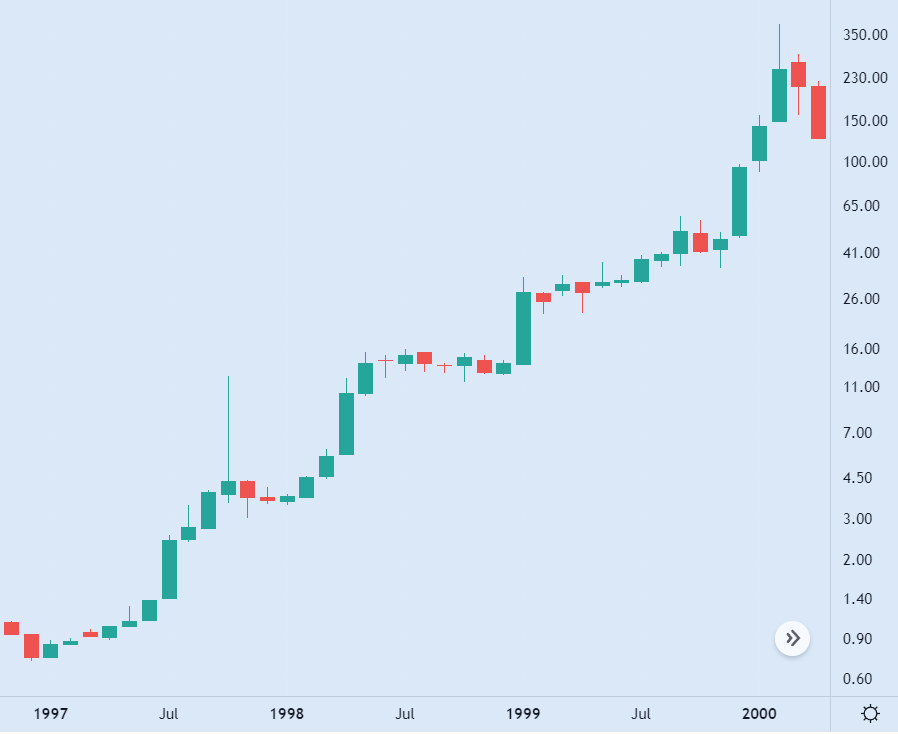

The stock price of Wipro was ₹ 1 per share in April 1997. Just two years later, in what is now called as the ‘dot com bubble’, the share price of Wipro rose to a high of ₹ 388 per share in February 2000.

388 times in 3 years. That was the kind of craze some of these IT stocks had among investors.

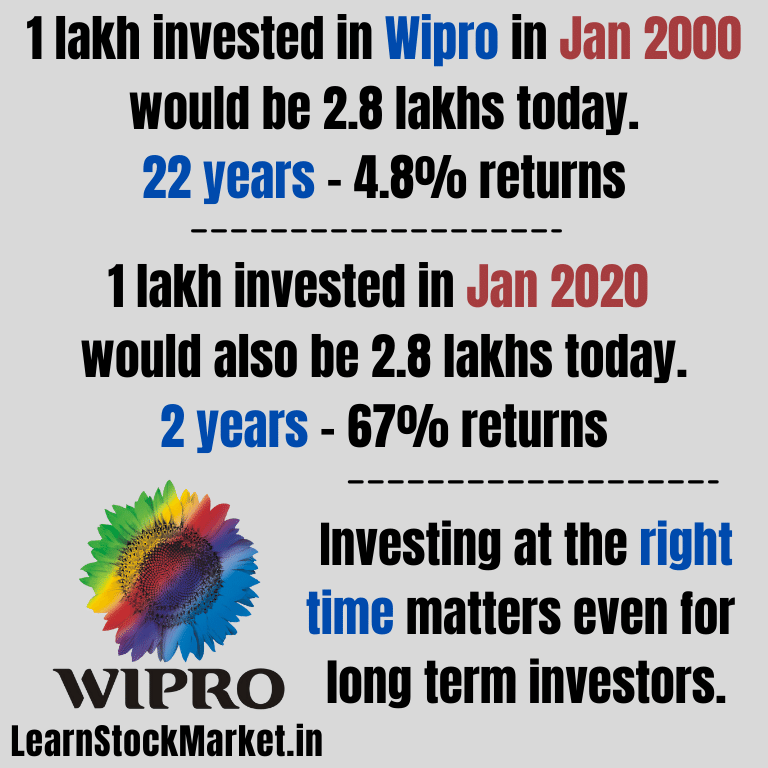

Even though the stock is the same, the returns investors get can be very different:

- Those who invested in the early stages of the bull market and were lucky enough to sell early when the ‘dot com bubble’ burst, made insane amounts of money.

- Early investors who stayed invested even after 22 years, have still made a lot of money.

- Late investors who realized their mistake and sold, did fine.

- But those who suffered the most were the late investors who stayed invested for 22 years.

From a high of ₹ 388 per share in February 2000, the stock crashed to ₹ 30 per share in July 2003.

It recovered in the next few years but fell again to ₹ 45 per share during the 2008 market crash.

It was not until the bull market in 2020, when those ‘late investors’ 20 years ago began to see some gains from one of the top IT companies in India.

What are some of the lessons we can learn from this?

- Never become an investor in sectors which are carrying too much hype / craze.

- If there is ‘FOMO’ (fear of missing out), it is better to take a trade with stop loss.

- Never invest into stocks which have recently gone up 5-10 times. Always wait for a price correction or time correction. No stock ever goes up in a straight line, they always give opportunities.

Most important: Investing at the ‘right time’ matters even for long term investments who invest in the best of companies.

Here’s the reason why:

Wipro was always a top-notch company – but even good companies can stagnate for several years.

Example:

- Reliance did not any returns between 2007 and 2017. Then suddenly went up 4x.

- Hindustan Unilever (HUL) did not give any returns between 1999 to 2010. Then went up 10 times in the next 10 years.

- Larsen and Toubro, India’s biggest infra company, did not give any returns between 2008 and 2020. Those who invested towards the end of 2007 / early 2008 have got less than FD (fixed deposit) returns.

- ITC hasn’t given any returns for 8 years between 2013 to 2021.

We are talking about some of the best companies in India here. Some of the biggest wealth generators of the past. Even such companies undergo long periods of time correction.

When the valuations soar too high, and earnings growth of the company doesn’t match up – only two things can happen:

- Price correction: The stock will fall in price.

- Time correction: In case of top-quality companies, the price will stagnate for several months / years.

When the price falls, it is usually easier to identify and even get out of the stock. But when the price stagnates, taking a decision becomes that much more difficult.

What are your thoughts? Do you own any company which has not given any returns for a long period of time? Tell us in the comments section below.

hi, do you think pain for ITC is over? Could you please do an analysis of ITC ?

thanks,

Midhun