Let’s say you were consistent with your mutual fund SIPs for 10 years. Your funds perform very well, and you earn compounded returns of 20% CAGR.

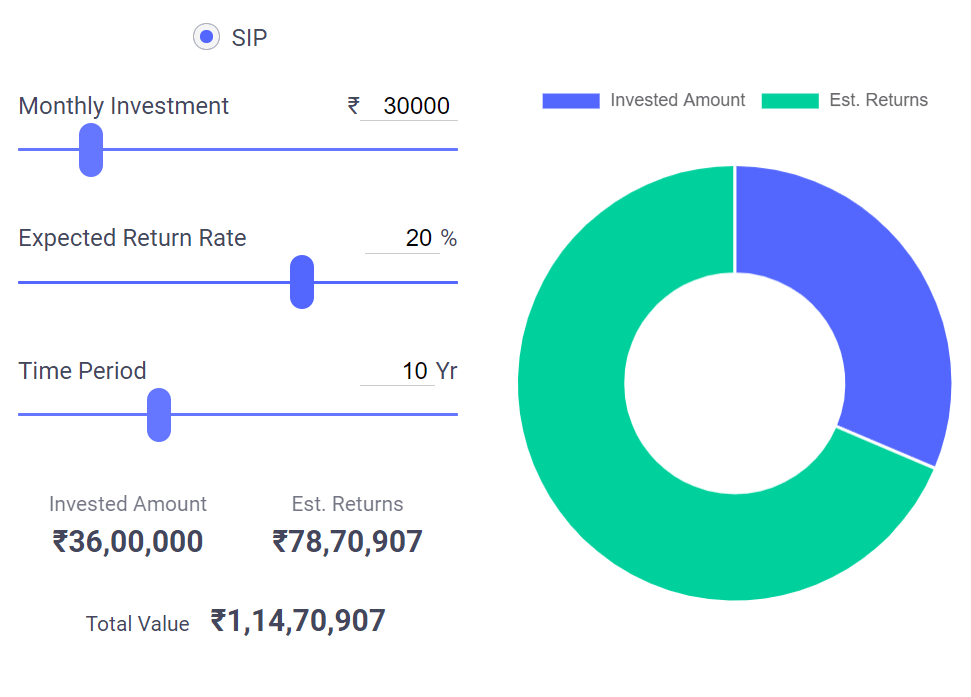

If you were consistently investing ₹ 30,000 (Example) every month for 10 years, the value of your mutual funds would be ₹ 1.15 crore.

Excellent returns. You have done well.

In the 11th year, you watch a few videos on YouTube and learn about investing. There is so much information around these days.

Meanwhile, a strong bull market is in progress currently – after the March 2020 crash.

You see a lot of smaller companies performing very well. Some are rising 5-10% everyday!

Some of your friends are saying, they have tripled their investment in JSW Steel. In just 6 months. In comparison, your mutual funds have done poorly.

You start thinking – why can’t I invest on my own? Mutual funds have given 20% compounded returns over 10 years, what if I can invest in a few stocks and double my money within a year?

This question usually comes to your mind when the market is performing very well and you get confidence after the market has already run up a lot.

You withdraw some part of your mutual fund and invest in some stocks. Boom, those stocks do well.

You get confidence. You withdraw more money, invest it in some metal stocks. Those give quick 20-30% returns.

Your confidence is now at an all time high. Why did I waste my time in mutual funds, when I had the potential and skill to do as well as Rakesh Jhunjhunwala?!

You withdraw all the money from mutual funds, and invest it in some Sugar stocks. Unaware that these are cyclical companies.

You sold Mutual Funds which were invested in steady compounders like HDFC Bank, Bajaj Finance, Reliance Industries, and bought some fast-rising trending stocks which are hitting upper circuits.

Soon, Covid becomes history. There is a vaccine, there is cure. Cases in India crash. Business is back to normal. The country resumes its growth story. Business channels are giving big targets to the Nifty.

In 2021, there was so much negativity all around. But market did not crash.

In 2022, there is so much positivity. How can the market crash? Nifty is heading towards 25k and 30k!

Meanwhile, the market is falling and rising quickly. You are accustomed to 5-10% falls.

You begin to believe the falls are temporary and the rise is permanent. You also believe in “buying the dip”. This is how the market prepares you, psychologically.

This is also because when the smarter players sell, they need someone to buy. Without a buyer, how can they sell their stocks?

And one day, there is a large fall. And the fall continues. This time it doesn’t rise. And before you know it, some of your stocks have already fallen 30-40%.

The value of your portfolio was nearly 1.5 crore. It’s down to 1 crore now. Surely you cannot sell now.

You become a long-term investor. I will hold these stocks forever. They will rise one day, you tell yourself.

Some of the bad companies continue to fall. The cyclicals hit their bottom end. And before you know it, the value of your portfolio is down to 60-70 lakhs. All within a year.

This has happened to several investors in 2017, including a well-known fund manager from the south. I do not want to take names here, but some of the portfolios he was managing crashed more than 75%.

75% crash means, an investment of 1 crore becomes 25 lakhs. From here, it has to rise 300% for you to just recover your investment!

Let’s get back to our example.

The hard-earned 1.15 crore invested in mutual funds, gave you compounded returns of 20% CAGR over 10 years.

Now it has become 60 lakhs after just 1 year. What are your net returns over the 11-year period? It’s just 6.25%. Your fixed deposit would’ve given you similar returns.

Over 10 years, you put ₹ 30,000 each month. The total invested amount was ₹ 36 lakhs. This had grown into 1.15 crore. But it was all lost in 1 year.

Outperformance of 10 years, gone with 1 year of over-confidence.

This has happened to many people I know in 2017. Some even sold their land and gold to invest in stocks and lost it all.

And what I see around me today, the ease with which people are trading and investing in stocks. I fear it will happen again.

Hard-earned money can be lost quickly and easily in the stock market. Always remember this.

You could do well for 10 or even 20 years, but one year of mistakes. One year of negligence or one year of over-confidence – can destroy it all!

Learn risk management. Spread out your investments. The money you need for the next 1-2 years, keep it in a fixed deposit.

Always have 50% of your investments in quality large cap names. These may not run fast, but when the market falls, they won’t crash like smaller companies either. This will give stability to your portfolio.

If you have any questions, you can always ask in the comments section below.

The timeliness of this article is exceedingly good. Keep up the good work.

When all the investment blogs tell you to park the short-term money in debt /liquid funds, you are advised to keep on FD. I always thought the same.