‘Balance Sheet’ is thought to be complicated, especially by people without knowledge of finance.

Let’s try to make it as simple as possible.

Balance Sheet is statement which lists all the assets and liabilities of a company, from the time it was started.

Let’s break it down further.

- Asset: Anything owned by the company is an asset. For example; land, machinery, buildings, furniture, cash etc.

- Liabilities: Anything the company ‘owes’ is a liability. For example; bank loans, shareholder equity etc.

It’s called ‘Balance’ Sheet because the numbers in ‘Assets’ and ‘Liabilities’ should balance or match.

Why?

Let’s take a simple example.

- You take ₹ 10,000 loan from a bank to start a business. This is a liability.

- You buy furniture worth ₹ 5,000, Ceiling Fan and Lights worth 3,000. The remaining ₹ 2000 out of ₹ 10,000 loan, is the cash. All these are assets.

- What’s the total? ₹ 10,000 in assets and ₹ 10,000 in liabilities.

And that is what we call as ‘Balance Sheet’.

In a company’s balance sheet these assets and liabilities are divided into categories and sub categories with names that sound complicated.

In reality, if you try to understand what the terms actually mean, you’ll realise everything is simple and straight forward.

How new investors should read Balance Sheet

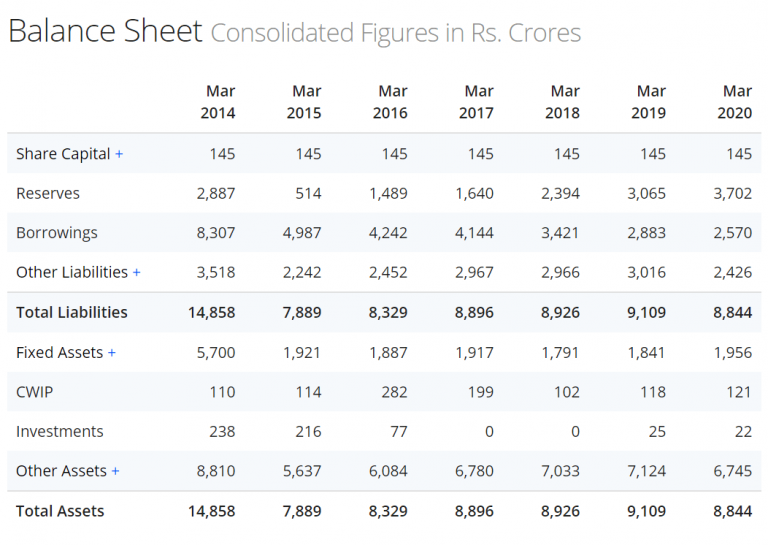

The below image is a simplified balance sheet of United Spirits Limited.

Balance Sheets are always marked ‘as on’ – Example: United Spirits Balance Sheet as on 31st March 2020.

You do not need to understand anything from the image, just scroll below and read the next paragraph and use the image as reference.

Share Capital is the capital of the company for which shares have been issued. Ideally, this share capital number should remain the same over the years. It’s a healthy sign.

If the Share Capital is increasing, it means there has been ‘share dilution’. Of course, there are exceptions like bonus issue of shares when the share capital will increase – but this makes no difference to the value of the share.

Notice how the ‘Share Capital’ value of ₹ 145 crore in the image above, has been the same from 2014 till 2020. This means, United Spirits hasn’t diluted the shares of the company in the last 7 years.

Next, the Reserves – which is also called ‘Reserves and Surplus’.

This includes the profits that a company has earned and kept aside, also called as ‘Retained Earnings’. It is from this ‘Reserves and Surplus’ that dividends are given to shareholders.

This is also the reason why ‘Share Capital + Reserves and Surplus’ is called as ‘Shareholders Funds’. Because these funds belong to all the shareholders of the company.

If ‘Reserves and Surplus’ is increasing every year, it is a positive sign.

In the image above, the ‘Reserves’ of United Spirits was at ₹ 514 crore in 2015. Since then, it has been increasing every year. This means, the business of the company is growing.

Then comes ‘Borrowings’ which is debt or loans the company has taken. Ideally, the ‘Borrowings’ should be lower than the ‘Reserves’. This is because, if the debt taken by the company is more than its cash reserves, then the company could be in trouble in the future.

This does not apply to banks or companies that lend money – their borrowings will always be high, because their business is giving loans to other companies.

Other than banks or other lenders, for most other companies, make sure the ‘Debt’ is very low or zero. A company with zero debt is called ‘Debt Free Company’.

You should also read about an important ratio called ‘Debt to Equity‘ which is the Borrowings divided by Share Capital + Reserves.

Back to the example of United Spirits. The borrowings were as high as ₹ 8307 crore in 2014 – which has gradually reduced to ₹ 2570 crore as on March 31st 2020.

In 2014, notice how the debt of the company was nearly 3 times more than the reserves. But gradually, the debt has decreased and the reserves has increased. The debt to equity ratio has gone below 1, which is a positive sign.

The comparison of Balance Sheets for the last 7 years, is a huge positive for United Spirits:

- The ‘Share Capital’ has remained the same.

- The ‘Reserves and Surplus’ has been increased, which means the profits of the company are also increasing.

- The ‘Borrowing’ or ‘Debt’ has been decreasing, which means the company has been able to pay off the loans. Interest which is to be paid for the loan also decreases.

This is how you look at simple numbers in the balance sheet and decide whether you should dig deeper and study the company in more detail.

If the debt is very high, avoid. If the reserves are decreasing each year, avoid. If the share capital is increasing without any strong reason, avoid.

Where to find Balance Sheets?

The most accurate Balance Sheet of a company will be available in the ‘Annual Reports’ which all listed companies release after the end of the financial year on March 31st.

Some companies release annual reports in April, others release it between May to September.

You can find links to all the major annual reports on this link.

On MoneyControl, search for the name of any company, then click on ‘Financials’ and then ‘Balance Sheet’. You will find the detailed information for the last several years.

On Screener.in, search the name of a company. On top of the page, just below the name and description of the company, you will find the Balance Sheet tab. Or else, you can also scroll down and find the entire balance sheet in the bottom half of the page.

Importance of Balance Sheet

The Balance Sheet, along with the ‘Profit and Loss statement’, are important financial documents which every long-term shareholder should read and understand.

- The balance sheet will give a clear picture on the financial health of a company.

- A quick glimpse at the balance sheet can tell investors whether they should learn more about the company, or avoid investing in it.

- Comparing the current balance sheet with previous years will give a clearer picture on growth.

- Banks check the balance sheet of the company before lending loans.

- During economic crisis, companies with a strong balance sheet survive and even thrive – as lesser competitors either fall or struggle to survive.

These are the basics. The ‘Balance Sheet Format’, along with what each term means, will be updated shortly.

If you have any questions, feel free to ask in the comments section below.

Please check & correct this lines in this article:

“You should also read about an important ratio called ‘Debt to Equity‘ which is the Share Capital + Reserves divided by Borrowings.”

Debt to Equity ratio should be Borrowings divided by Share Capital + Reserves.

Thankyou

Thank you. The mistake has been rectified. Hope you liked the article.

very good. please add more points if necessary