The shares of IRCTC have been split 1:5 – which means if you had 1 share of the company yesterday, you would have 5 shares of the company today.

The stock price also gets adjusted. If the price was ₹ 100 yesterday, after the 1:5 stock split it would reduce to ₹ 20.

In short, stock split is ‘no gain no loss’.

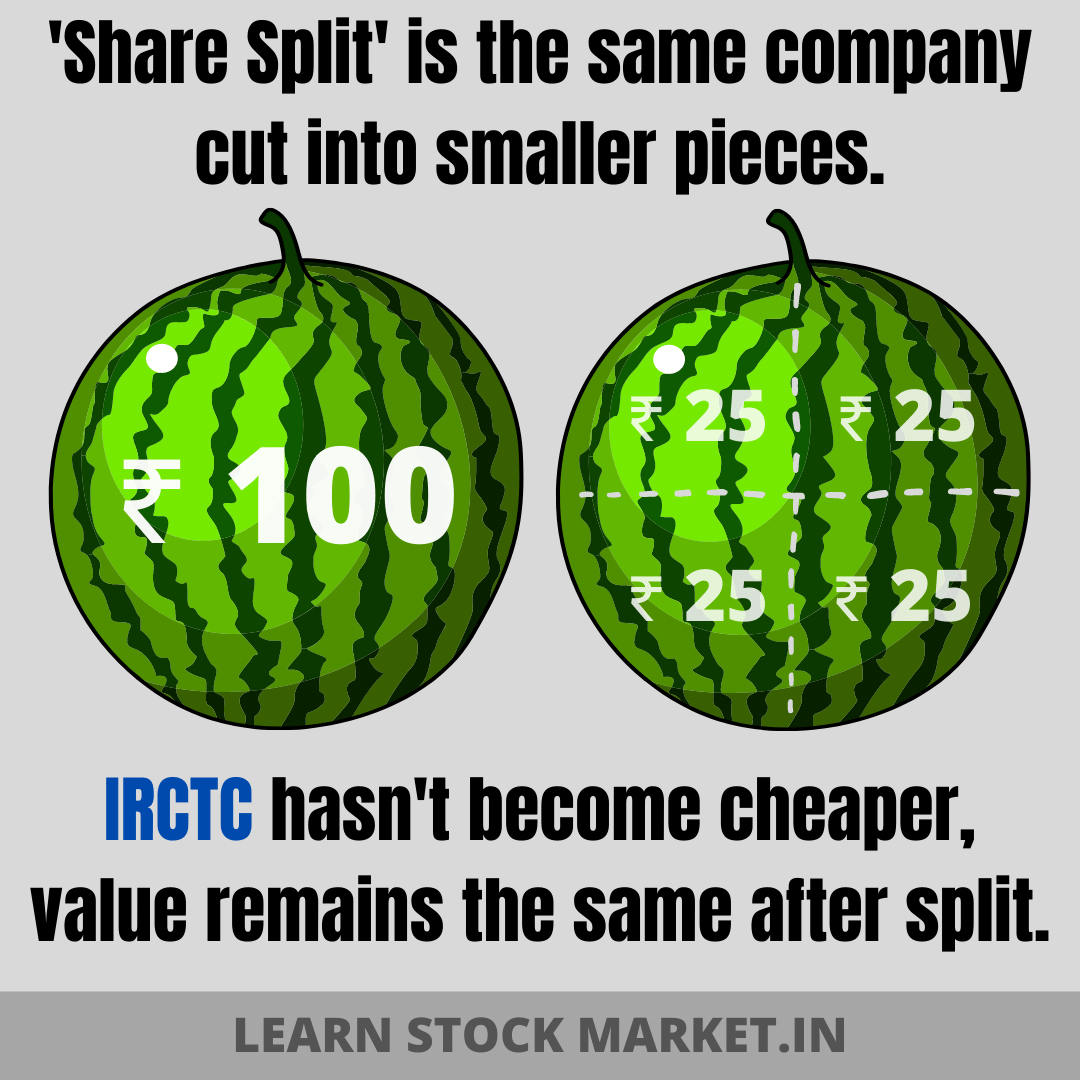

To understand this better, let us take a simple example. You go to the market to buy a watermelon.

The whole fruit costs ₹ 100. Now, if the same watermelon is cut into 4 pieces – each piece would cost ₹ 25.

If you buy the watermelon after the split – the price and value you get remains the same.

Before the split, the share price of IRCTC was ₹ 4130 per share. Today, after the split the share price opened at ₹ 817.

If you had 1 share yesterday, the value would be ₹ 4130. Today, you have 5 shares of the same company, the value of 5 shares is 5 x 817 = ₹ 4085. Not much difference in the value, it is almost the same.

As the day progressed, there was huge demand to buy shares of IRCTC. So the price increased and closed at ₹ 913 per share. A big gain, but there is news today that Government will be taking 50% share of the convenience fee which IRCTC charges on their ticket booking website. This will have a significant impact on the business and the shares of the company should fall.

More on this tomorrow.

Some frequently asked questions:

Should I buy IRCTC after the split?

The answer is no. You should not buy JUST because the shares have been split. Even though the price is lower, the shares are not cheaper. The fundamentals of the company are the same as it was before the split.

Should I sell IRCTC after the split?

Again, the answer is no. If you have done your analysis, then share split makes no difference to you. If you bought the shares just because you expected the price to rise after the split, then you should sell it. The information given in this article is for investors only – not traders (intraday, positional etc)

Why did IRCTC share price rise after the split?

Even though the value of the company remains the same, share prices can sometimes rise after the split. Most people are used to seeing IRCTC at higher prices. When the price suddenly falls after the split, psychologically it appears cheaper.

Also, those who are new to the stock market might think the price has actually crashed and start buying.

Experienced traders and those who are involved in the ‘Futures and Options’ (FnO) market, can sometimes take advantage of such situations. When the price rises just after the split, demand increases – more people come to buy the shares. It is at this time that smarter traders could sell and book their profits.

In short, unless you are a very experienced trader, avoid trying to make quick money in the stock market. There is no quick or easy money here. Even if you make some money by playing the ‘split or bonus’ story – you will end up giving the profits back to the market when your next trade goes wrong.

When will the split shares be credited to demat account?

It should take a few days. But remember, if you want to sell IRCTC tomorrow – you can only sell the 1 share you have (or the number of shares you had before split). You will have to wait for the remaining 4 shares till it gets credited.

Leave a Comment