A good company purchased at a wrong time, may not give good gains for several years.

A bad company purchased at the right time – can end up giving exceptionally good returns.

Anything can happen in the stock market. And in my case, it was a fraud company which ended up giving extraordinary returns. With plenty of luck, of course.

Today, I will tell you a story about my investment in a terrible company – a trade which ended up giving me 3x returns. The kind of ‘quick crazy returns’ which I have not got since.

The name of the company was ‘Sanwaria Agro Oils Limited’. Do not look for the share price now, it is less than a rupee.

Back in 2017, at the peak of the ‘mid-small cap’ bull run, a narrative was created on social media and other research websites about the tremendous potential of the company to become a major ‘FMCG’ player.

In the same year, the company changed its name from ‘Sanwaria Agro Oils’ to ‘Sanwaria Consumer Limited’.

While the hype was tremendous, I managed to buy shares at around ₹ 12-13. Soon after my purchase, 1:1 bonus shares were issued and my price adjusting for the bonus came to around ₹ 6.5 per share.

Even though I strictly avoid any ‘penny stocks’, it was a trade in Sanwaria, not a long-term investment. It was about entering the stock, riding through the euphoria and exiting on time.

Within days, the share price started hitting ‘upper circuits’. Every morning it would rise by 5%. There were no sellers, only buyers.

Back in those days, a website I frequently visited – ‘Valuepickr’ – also had a discussion on the same company. There were reports of Morgan Stanley and Goldman Sachs investing in the company.

Patanjali was said to be a client of ‘Sanwaria Consumer’. A top ratings agency like ‘CARE Ratings’ had put out a positive report on the excellent valuations of the company and growth potential.

Newspapers were covering ‘Sanwaria’ as the stock which had given the highest gains in the last few months.

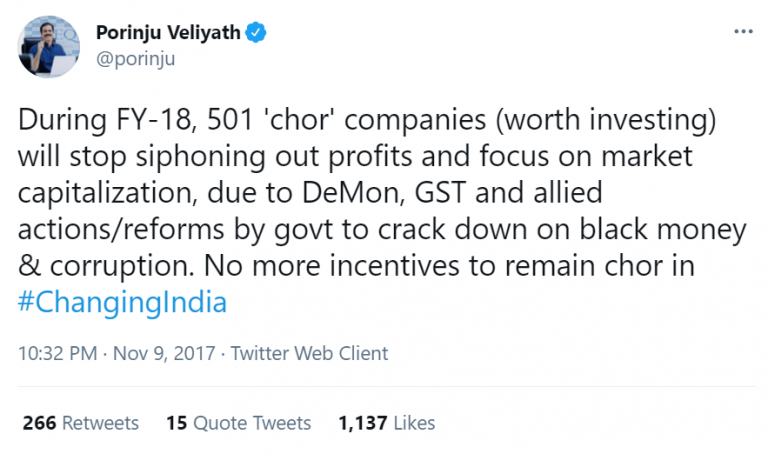

Fund manager Porinju Veliyath, the mid and small cap hero in 2017, was tweeting that it was time for ‘chor companies’ to turnaround and shine in ‘Changing India’.

The share price was going up every day and this was followed by a positive piece of news – most of which was released by the company itself. Some of their ‘corporate announcements’ released on stock exchanges were funny to say the least.

This was a major red flag (negative), but I continued to hold the company as it had already become 3-4x from my initial investment.

All those gains were made in just 2-3 months (see the chart below).

Sitting on big gains, I continued to notice several red flags:

- The company was releasing their results just 2 or 3 days after the end of a quarter. After the end of July-September quarter, the company declared the results just 3 days after on 3rd October. 1st was Sunday and 2nd was holiday for Gandhi Jayanti. It was becoming clear that the numbers were made up.

- Most of their investor con-calls were focused on the share price, and not the business itself. The management went to the extent of responding to people who were posting negative comments on the MoneyControl forum.

- The decision-making time came when the promoters sold 3 crore shares of the company – claiming the sale was made to settle short term debt.

I sold all shares of the company at an average price of 19 per share. The purchase was for ₹ 6.5.

Extraordinary gains. And because of this, I continued to track the company even after I sold my shares.

The share price was up and down soon after I sold it. But later, it all went downhill. The price crashed. It became clear that it was a ‘pump and dump’ story – planned by the promoters.

With the benefit of hindsight, investing in a company that hits ‘upper circuits’ every day, appears to be foolish – but 2017 was that kind of year.

Junk stocks were quoting 50-60PE. That’s the kind of valuation a FMCG like Nestle India commands. Most of these stocks were outperforming quality compounders by a distance. The quality of stock portfolios was at its lowest this year.

Those who had seen previous cycles and exited on time, made a lot of money. Those who were new to the market and thought some of those stocks will rise forever, were wiped out.

Many lost 50-75% of their investment, some lost everything.

The 2020-21 rally has been broader, quality names have contributed and performed – unlike 2017. Yet almost everyone I know is ‘investing’ in the market. Greed is high, and there is a feeling among people – especially those who are new – that making money in the stock market is easy.

It is time to be a little fearful when others are greedy.

I like the valuable info you provide in your articles. I’ll bookmark your website and check once more right here regularly. I’m quite sure I’ll learn a lot of new stuff.