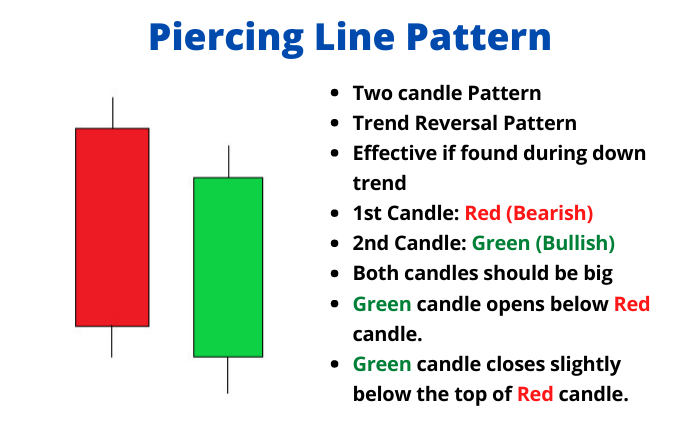

The Piercing Line Pattern is a two-candle pattern that forms after the price has fallen.

If it forms during a downtrend, it signals a possible turn towards an uptrend.

For the pattern to be called ‘Piercing Line’, the following has to happen:

- The stock has to be in a downtrend.

- The first candle has to be red (bearish).

- The second candle has to be green (bullish).

- The second green candle has to open lower than the first red candle.

- The second candle has to rise and close below the top of the red candle.

Psychology of Piercing Line Pattern

As you read the next few paragraphs, try to visualize the formation of ‘Piercing Line’ Candlestick pattern on the chart.

A stock has been on a downtrend for the last few days. One day, a big red candle gets formed on the chart – the price could’ve fallen by 3-5% or more. The sellers are totally in control, bringing the price of the stock down.

On the second day, the stock opens gap down (i.e below the previous day’s closing price).

Then, suddenly the buyers recognize that the price has fallen quite a lot in the last few days – they begin to see value in the stock. They start buying, the price of the stock starts going up.

Before the end of the day – the stock rises to close slightly below the previous day’s opening (i.e below the top of previous day’s red candle).

This kind of sharp upward movement after a steady fall in the price over the last few days or weeks – suggests that the stock could reverse and begin moving upwards.

How traders use ‘Piercing Line’ Pattern

Let’s take an example first, after which the trade will be explained in detail.

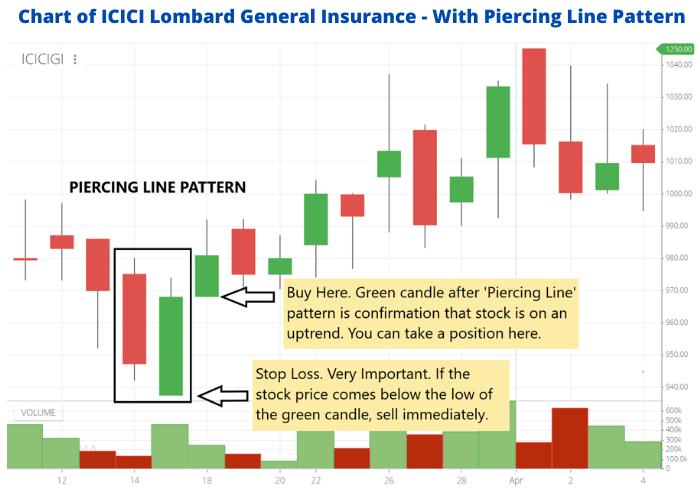

- The above image is a real chart of ICICI Lombard General Insurance.

- At the beginning of the image you can see the stock was on a downmove.

- Suddenly a big red candle appears.

- On the next day, the stock opens lower (gap down) and then rises higher to close just a little below the top of the red candle.

- This is a classic example of ‘Piercing Line’ Pattern.

How to execute the trade:

- Once the ‘Piercing Line’ Pattern has been formed. Traders can now wait for the confirmation.

- The confirmation comes when the day after the green candle, the stock once again opens in green (above the previous day’s closing price).

- When the confirmation comes, traders can buy the stock.

- The stop loss will be the bottom of the green candle. If the price goes below that, the ‘Piercing Line’ Pattern has failed. The trade is over, the stock should be sold and the loss should be booked.

Why Booking Loss is Important:

- Booking loss is a very important part of becoming a successful trader. If your setup has failed, the loss should be booked immediately. After that further analysis can be done on why the trade failed.

- Not taking loss and waiting for the stock to turnaround – is a mistake which many new traders do. If you bought because of the Piercing Line candlestick pattern, then if that pattern fails, you need to sell and get out of your position as soon as the stop loss hits.

- It’s better to enter the ‘Stop Loss’ in the system itself, so that the computer can automatically sell and book the loss.

Importance of Volume in Piercing Line Pattern:

Another important thing to notice is the volume. When the volume on the green candle is higher than the volume of the red candle, it’s considered to be a strong sign that the trade is likely to succeed.

In the above chart, check out the volume section at the bottom. Under the red candle, the volume is low. Under the green candle, the volume is much higher. This means, there was heavy buying on that day.

Piercing Line Pattern for Long Term Investors

This candlestick pattern is not meant for long term investors. It’s a short-term trend indicator. However, if you have been waiting to buy a stock and hold it for long – you could accumulate the stock when this pattern appears.

If a stock you like has been on a downtrend, wait till ‘trend reversal’ patterns like ‘Piercing Line’ appears on the chart. This will help you buy the stock for a lower price and just before it begins a short or long term turnaround.

Leave a Comment