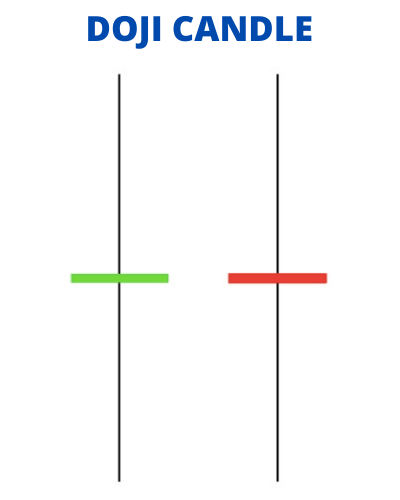

The Doji is a commonly found candle on the charts. It has a small body and long shadows.

It looks something like this:

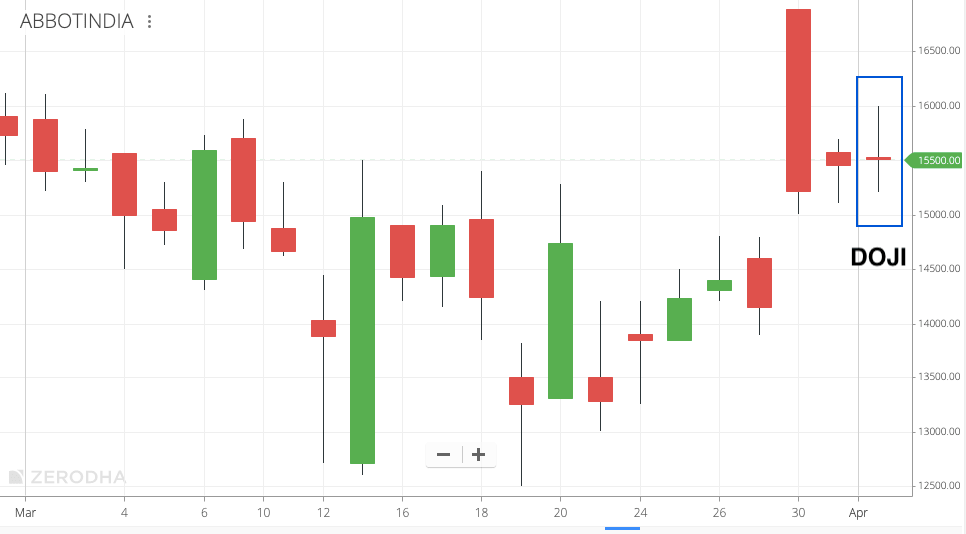

How a Doji looks on the chart:

- A Doji has a very small body, which can be red or green. The colour does not matter.

- It has to have a long shadow or stick, which is several times the size of its body.

A Doji can be ignored on a chart that is moving sideways. It has significance when a stock is in a clear uptrend or downtrend.

When a stock is in downtrend and a Doji gets formed, it means the sellers tried to take the stock down, but buyers showed interest and got the stock back up. This signals a possible trend reversal – from downtrend to uptrend.

When a Doji gets formed during an uptrend, it means the buyers tried to take the stock up, but the sellers got the stock down. It’s a sign of weakness and the level to which the Doji had reached at its peak, could be unsustainable price levels – due to which there was selling pressure.

Formation of Doji Candle

Look closely at the chart above. The last candle on the right side of the chart is a Doji candle. It was formed on 1st April 2020.

For that Doji candle, the price movement was as follows:

- Open – ₹ 15525

- High – ₹ 15995

- Low – ₹ 15202

- Close – ₹ 15500

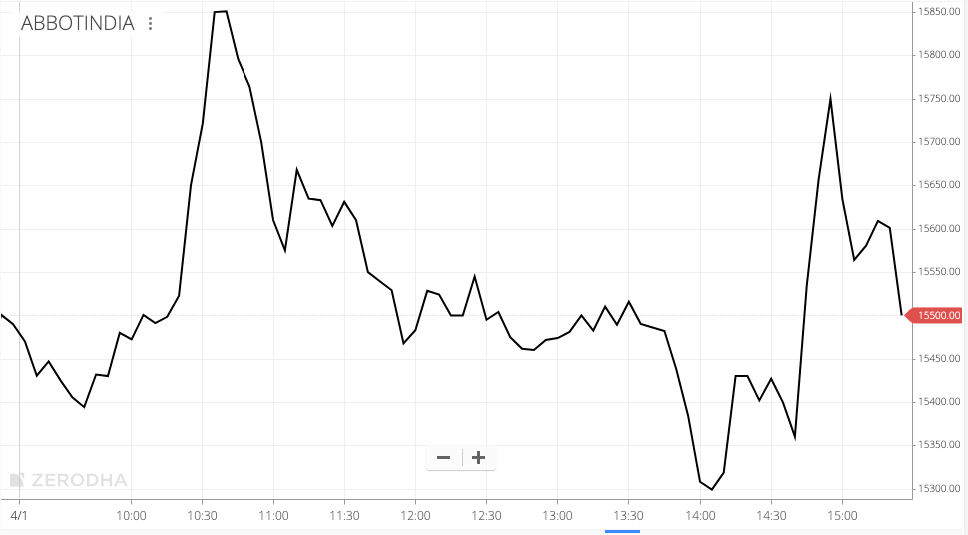

As you can see from the chart above, the price opened at 15525 per share. It fell early in the morning, then the bulls (buyers) took the price to a high of 15995 per share at around 10:40AM in the morning.

At that point, the price wasn’t sustainable. The bears (sellers) got into action and brought the price down. The fall continued till around 2PM in the afternoon when the share went below 15300 – before going up again and closing at 15500.

Notice how the opening price of 15525 and closing price of 15500 are around the same. But the high of the day and low of the day were extreme.

Both sellers and buyers tried to take control, but they couldn’t. In the end, the price neither went up, nor did it fall down by much.

This is how the Doji got formed on the chart.

The Doji we discussed on this page is called a common Doji. There are other types of Doji’s like Long-Legged Doji, Dargonfly Doji and Gravestone Doji.

All these will be discussed in separate articles. Stay tuned

Leave a Comment