In a lot of articles on this website, we often talk about ‘price correction’ and ‘time correction’. We already have an article on time correction.

Our readers have been asking for an article on price correction.

The concept is simple, which is why we thought it doesn’t require a detailed article. However, since you asked for it, let’s get started.

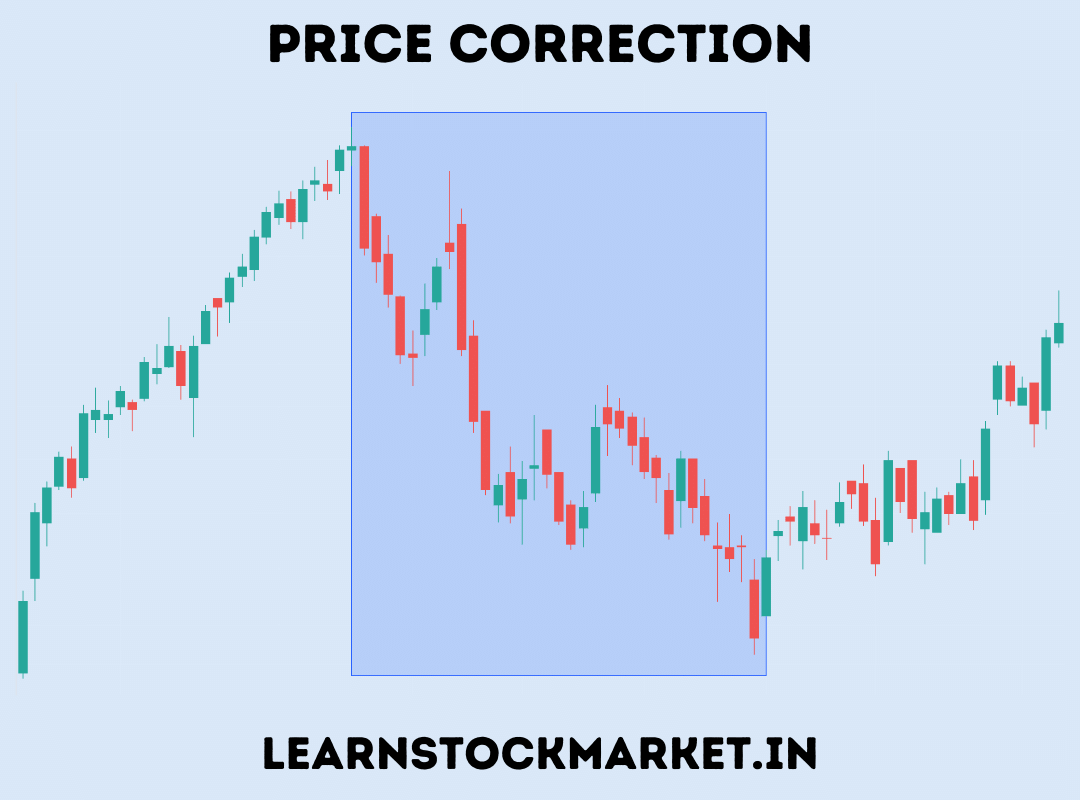

Price Correction Meaning: When the price of a stock falls, it is called price correction. As simple as that.

Let’s take an example of price correction in stock market.

That’s the chart of Asian Paints from the beginning of December 2020 to end of March 2021.

The stock was in a steady uptrend after the stock market crash in March 2020.

It peaked in the first week of January 2021 and after that there was a period of ‘price correction’.

From a high of ₹ 2875 on 11th January 2021, Asian Paints fell to a low of ₹ 2260 on 26th February 2021.

This entire period when the price fell – is what we call as Price Correction.

Was there anything wrong with the company? Not really.

Why did the price fall? It fell because every stock that rises has to fall. People attach various reasons to corrections, but they can happen for a reason or sometimes for no reason at all.

Common reasons for price corrections:

- A stock which rises a lot and becomes overvalued can undergo a price correction.

- Poor quarterly financial results can lead to fall in price.

- Excellent financial results can sometimes also lead to fall in stock price. Except the unexpected in the stock market – because most of the news is already ‘priced-in’.

- Bad news related to a company, like frauds etc. can also lead to significant price corrections.

- Stock prices can also fall due to change in market sentiment.

- External factors, global developments which affect a business can lead to price falls.

- Sometimes a stock can fall for no reason at all.

Always remember one thing. Even the best of companies, which has delivered excellent returns to shareholders – can undergo long periods of price correction as well as time correction.

In case of cyclical companies, the price can start falling when the business is at its peak and there is positivity all around.

For example, Maruti Suzuki. Back in 2018, the company was announcing record sales. But the price correction began in September 2018 – months before the car sales began to fall.

By the time the company started declaring poor quarterly numbers, the stock price was already down nearly 35-40%.

This can happen in the market. You could have a major company declaring their best-ever results and that very day could be the top for the stock price.

To understand “why the stock price fell” and “till where it could fall” – you need to spend more time in the market. Understand the market psychology, learn to analyze chart – and even after all of this, you can only increase your probability of entering the stock at the right time and price.

You can never accurately predict anything in the market.

That’s the article on Price correction. If you have any questions, please ask in the comments section below.

Leave a Comment