A lot of people are confused between Direct Stock Market Investment vs Index Funds and Mutual Funds.

Let’s understand what they are:

Index Funds: A copy of an index. For example, if you buy Nifty 50 index fund – your money will be invested into all the 50 stocks that are in Nifty 50. If Nifty goes from 10,000 to 11,000 – the value of your money will also increase by 10%. The charges are low.

Mutual Fund: The money you invest will be handled by a fund manager. He will use his expertise and experience to invest in stocks. The charges are higher than index funds. Every year you will pay somewhere between 1-3% as fees. For example, if you invest ₹ 1 lakh, you will be paying around 1000 to 3000 rupees every year – depending on which fund you buy.

Direct Stock Investing: You research on your own and buy stock which you like. There are advantages and disadvantages to this. But if you have the time and interest to learn – not only can you get better returns than the market, but there is also a sense of accomplishment. You work hard, you make mistakes, you learn and eventually earn. Nothing can be better than this.

Quick Comparison:

| Type | Risk | Effort | Cost |

| Index Fund | Low | Low | Low |

| Mutual Fund | Medium | Medium* | High |

| Direct Investing | High | High | Low* |

* To invest directly in stocks, you need to pay somewhere around ₹300 – 500 every year as annual maintenance charge for your demat account. If you invest for long term i.e if you buy and hold stocks for a long period of time – then the transaction charges are very low if you open an account with discount brokers like Zerodha. In short, if you invest ₹ 1 lakh, you will only be paying ₹ 111 as government taxes and other charges. This is 0.011%. All included, this is much lower than mutual funds, as well as most index funds.

* Mutual Fund is marked as ‘Medium Effort’ because there are so many mutual funds – effort will be involved in picking the right fund, learning more about the fund manager, his investing style etc.

Also note: In the ‘Risk’ column, Index Funds are categorized as ‘Low Risk’. Be aware that all kinds of equity investment has market-related risk. The value of your investment could rise and fall at any time or any moment. So, stock market in itself is ‘High Risk’ – which is why it can also give the best returns compared to other forms of investment.

Direct Stock Market Investment

Advantages of Direct Stock Investment:

- The knowledge you get will be 10 times more than the knowledge you got from school. The market will not only make you a more knowledgeable person, it’ll also make you a better individual. This reason alone, makes it worth investing your time in learning stock market investing.

- It’s such a vast field. You will learn about various industries, top-notch businesses and the visionaries who run them. You also get to learn about the economy, global and national. It’s all connected.

- There is also the psychological aspect of investing. When it comes to index funds or mutual funds, very little of your emotion is involved. You only see the ‘NAV’ (Net Asset Value). You do not really get to know at what price a stock was bought or sold.

- Whereas in direct investing, you have to decide the ‘buy price’ as well as the ‘sell price’. When you buy, the price will either go higher or lower. If it goes lower, the fear of loss will begin to affect your mind. If it goes higher, the market will either make you sell too early or it will create a sense of greed within you – which you will have to overcome to become a successful investor.

- I would say, the psychological aspect itself is about 75% of investing. In the initial years, as you learn, you will also be fine-tuning your brain and its thought-process to become a better investor.

- The sense of achievement or accomplishment is also one of the rewards you get from direct stock investing. You have to do-it-all by yourself. If you win, the satisfaction you get is immense. It’s incomparable really. Index or Mutual Funds is as boring as fixed deposits.

- And if you are willing to put the time and effort to learn. If you love the market and everything about it, the returns you get will be more than any other investment class. Especially in a growing country like India.

Disadvantages of Direct Stock Investment:

- It’s difficult and definitely not meant for everyone. The learning stage is long and initially you will lose money in the market. If you are the kind of person who cannot take losses, or see your portfolio in ‘red’, stock market is not meant for you.

- The human mind is not designed to be compatible with the stock market. The market will make you buy when its rising and sell when its falling. The market will confuse you, it’ll go against all logic. It’ll do the opposite of what so-called ‘market experts’ say on television. Getting ‘mental clarity’ will take time. Most people give up in the first 1-2 years itself.

- Also, there are so many companies out there. More than 7000 listed on the two stock exchanges. Picking the best 15-20 stocks will prove to be challenging initially.

- Again, most of the points mentioned here are troubles that beginners face. It’s all about learning and experiencing the market.

- Small investors who invest in mid and small caps have very little access to internal information. Finance fraud has happened in some of the biggest companies in the country. In smaller companies, there are many poor quality companies and fraud promoters. Without enough information, a small investor struggles to identify major issues before its too late.

Index Funds

Advantages of Index Funds:

- The biggest plus is you do not have to worry about the performance of the fund manager. If you are investing in ‘Nifty 50’ index fund, your returns will match the performance of ‘Nifty 50’. If the country grows and performs well, indexes like ‘Nifty 50’, ‘Sensex’, ‘Nifty Next 50’ etc should do very well.

- The second big advantage is the costs are very low. Index funds are much cheaper than mutual funds because it does not require a fund manager and his team to research stocks and take decisions. A small team is good enough to exactly copy the index.

- There are only a few major indices, so picking your index fund is very easy. It all boils down to the cost. Pick the fund that has the lowest expense ratio.

- If you want to invest in equity with the least amount of risk and volatility, Nifty 50 or Sensex index funds are best suited for you.

Disadvantages of Index Funds:

- The best performing stocks (generally with high valuations) are added to the index. The worst performing stocks are removed from the index, but a little late. For example, on September 27 2019, Indiabulls Housing Finance was replaced by Nestle in the ‘Nifty 50’. The decision to remove came after the stock price fell from highs of ₹ 1400 to ₹ 390 per share.

- The same with ‘Yes Bank’ earlier this year. Now, Zee Entertainment and Bharti Infratel will be replaced with Divi’s Labs and SBI Life. A mutual fund manager would’ve sold stocks like ‘Yes Bank’ and ‘Indiabulls Housing Finance’ a lot earlier.

- In other words, you’ll be buying the Nifty 50 as it is. With its winners, losers, expensive and inexpensive stocks.

- The other problem with index funds is lack of ‘cash position’. When the market gets overvalued, a part of the funds cannot be sold and kept aside as cash. Whereas a mutual fund manager or direct stock investor can keep some money in ‘Savings Bank’ account to invest during corrections (falls) in the market.

- Lack of diversification can also be a problem. For example, quality mid or small caps can outperform the market.

Note: Index Funds only have two major disadvantages. It was divided into 4 parts to make it easier to read.

Mutual Funds

Advantages of Mutual Funds:

- A fund manager can design his portfolio the way he wants by picking the best companies. More so in a ‘multi cap’ fund, where the fund manager has the freedom to pick the best stocks from large, mid or small caps.

- If the market is over-valued, a mutual fund manager can sell a part of his holding and keep ‘cash’ to invest when the market corrects.

- Extremely easy to invest, you do not even need a demat account.

- Good mutual funds can beat the index and the ‘alpha’ of 2-3% can make a huge difference in the long run. This is very much possible in a growing country like India.

Disadvantages of Mutual Funds:

- The harsh reality – most mutual funds do not beat the index. And their charges are high. If a fund manager cannot beat the index, even though he has the backing of an entire research team, then it makes no sense to invest in his / her fund.

- From a investor point of view, there are too many choices. How to pick the best mutual fund? Most do not put the effort, but in reality, there is a need to learn more about the fund manager, his style of investing, his past performance and how long he has been in the market. Has he been through market cycles – like the 2008 crash?

- Next, even if a fund manager has been successful – past performance does not guarantee future returns.

Which is the best?

If you are a beginner, you should either opt for an index fund or mutual fund. Opt for a systematic investment plan (SIP) and invest in the market for returns.

Meanwhile, you can invest a small amount of money (let’s say 10% of your capital) by directly buying stocks. The knowledge and experience you gain here will be invaluable.

In fact, learning how to pick stocks and experiencing all the emotional ups and downs that the market will put us through – will also make you a better index fund or mutual fund investor.

Why?

Because, when most people invest in mutual funds or index funds – they think of it as an investment that will gradually grow over time. Most are not aware of the downside risk. When the market actually falls, most sell and get out.

If you just invest and learn nothing, chances are you will not make money from mutual or index funds too.

Understand one important thing. As a direct stock market investor, you have one big advantage. Prices are usually pushed higher when a big investor or fund manager buys shares of a company. If you manage to buy a company early when there is lesser investment interest in it, you stand to make huge gains.

For example, even in the biggest listed company of India, mutual fund were late to the ‘Reliance’ party. They started buying the company after it had already rallied a lot. The same with banks. They were heavily invested in banks and the corona-virus situation has wiped off years of returns.

Compare your performance to index

Once you gain 1-2 years of experience in direct investing, you could compare the performance of your portfolio to that of the index.

Are you performing better than Nifty or Sensex?

This is how I have been investing. After all, if I am not beating the index, then I would rather directly buy the index?

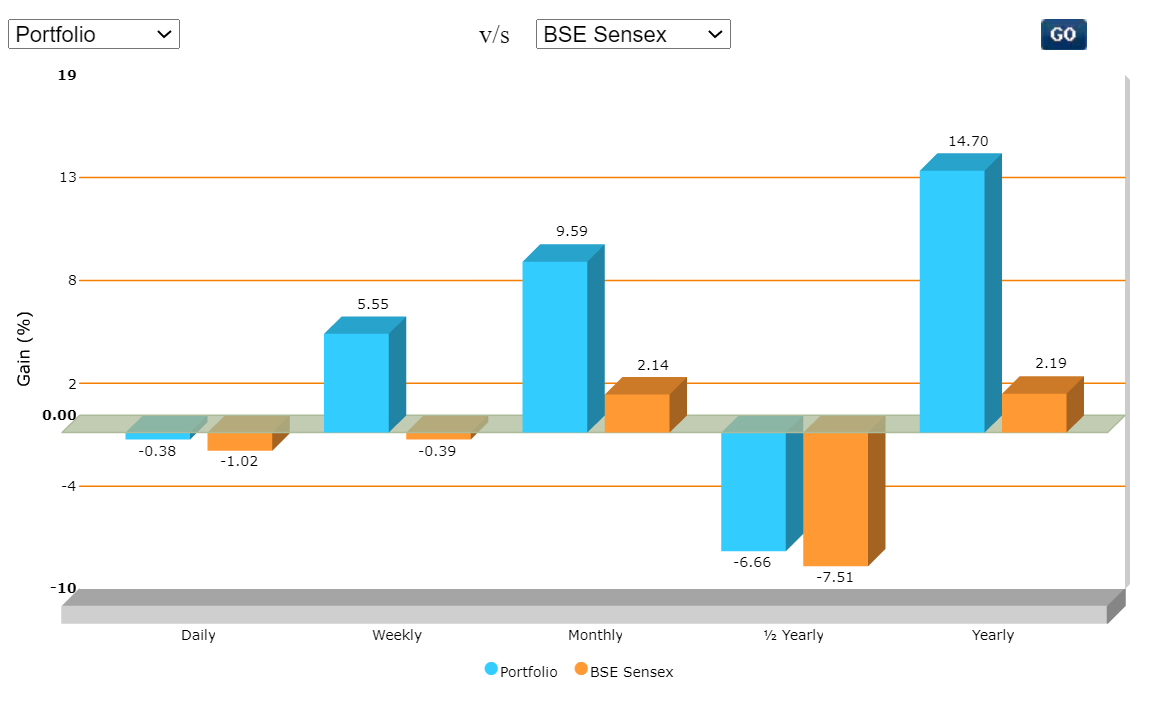

There is a handy feature in Moneycontrol, which lets you compare your portfolio to all the major indices. It’s called ‘Health Check’ – which is available in the Portfolio section.

Here’s my performance for the last one year:

That’s a clear out-performance of Sensex.

The daily, weekly and even monthly graph can be ignored because the short-term performance can vary. But in the last 6 months (1/2 yearly), my portfolio has fallen by 6.66% whereas Sensex has fallen by 7.51%.

The most important is the performance of last one year. My portfolio has gained by 14.7% whereas Sensex has given only 2.19% returns. That’s an alpha of 12.51%.

Unfortunately, Moneycontrol does not show performance for 3 or 5 years.

As a direct stock market investor, if you are beating the major indexes consistently over a 3-5 year period, you will do very well in the stock market.

So I suggest, you start investing in top companies with a small amount of money. In the first year, you will make mistakes. You might even lose money. Think of it as ‘tuition fee’ or ‘learning fee’ to the market.

Learn and be patient. After 1 – 2 years, start comparing your performance to Nifty or Sensex.

If you are slightly below Nifty, do not get discouraged. Continue learning. Eventually you’ll be able to perform on-par or better than Nifty. Believe in yourself.

However, if you are consistently losing money and significantly under-performing Nifty, then it’s time to understand that you learnt quite a lot and you are probably better suited to mutual fund or index fund investment.

Accept it and move on. But until then, learn and invest only a small amount. If you are making money, it’s still important to be grounded and slowly increase your investment.

To become a ‘good investor’ you have to experience atleast one full cycle of the market – the bull phase as well as the bear phase. Both will give you immense learning and a huge amount of knowledge.

Good luck.

We, at LearnStockMarket.in, are always here to help and guide.

Superb information and comparison.