How important is ‘Promoter Holding’ when investing in a stock? The answer is very important!

When investing in an Indian company, especially small and mid caps, the promoter holding is an important metric that you must check closely.

The Promoter Holding is released once every 3 months in the ‘Shareholding Pattern’.

Why is Promoter Holding important?

Well, if the owner of the business himself is selling the shares of his company – and if the reason is not revealed in the public – it could mean there is a problem in the company which isn’t publicly known.

Think about it.

If you are the owner of a big business and you hold 50% of the company’s shares. Why would you sell the shares if you expect the business to do well in the next few years?

If your business does well, the stock price should increase and owner will get richer.

However, if you know there is a problem with your business. If you know your company has indulged in some illegal activity and you are about to get caught for fraud – then you will be looking to sell your shares when the prices are high and there is demand to buy.

Promoter Holding Examples

Let’s take a few example to clearly understand what Promoter Holding is.

Below is the Promoter Holding of Reliance Industries for the last 5 quarters (all in percentages):

| Mar 2019 | Jun 2019 | Sep 2019 | Dec 2019 | Mar 2020 |

| 47.27 | 47.29 | 50.05 | 50.03 | 50.07 |

What do you think? Good or bad?

In March 2019, the Promoter Holding of Mukesh Ambani’s Reliance was 47.27%. This has increased gradually to 50.07% in March 2020.

The Ambani’s have been buying shares from the market. This means, they were finding value in the stock and were also confident of the business performing well in the next few years.

The owner of the company has the most in-depth knowledge of his business. Who knows what Mukesh Ambani is planning next?

He could launch Jio smartphones, Jio TVs or Cryptocurrency. It all happens in the secret boardrooms.

Only insiders know about future business plans. So when these insiders themselves are buying shares – it’s a sign of confidence in the future business prospects.

Another Example. Yes Bank!

| Mar 2019 | Jun 2019 | Sep 2019 | Dec 2019 | Mar 2020 |

| 19.8% | 19.78 | 13.05 | 8.33 | 1.42 |

What is happening here?

In March 2019 it was 19.8, it reduced to 19.87. Then it fell significantly and now it is close to zero.

Now, go check out the stock price. Yes Bank was quoting ₹ 270 per share in April 2019, the current price is ₹ 26. The story is over.

Professionally Managed Companies

There are two types of businesses; family-owned business and professionally-run businesses.

In a family owned business, the percentage of promoter holding is important.

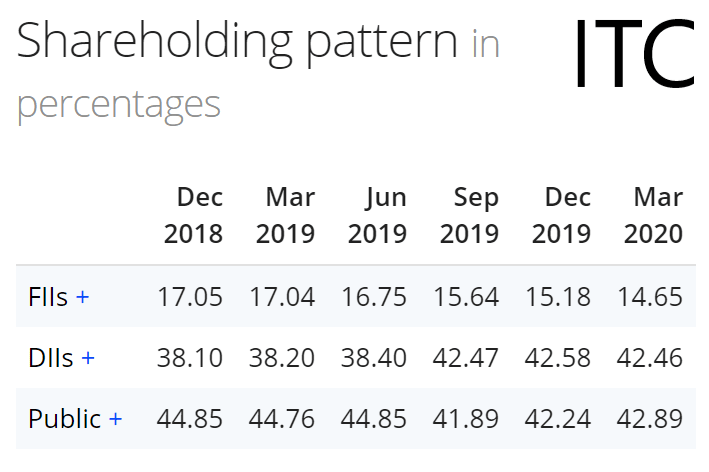

However, there are exceptions. Companies like ITC Ltd, Larsen and Toubro (L&T) are professionally-run businesses. These companies will have zero promoter holding.

An individual is not taking major decisions in such business. These businesses have not been inherited from father to son, like Dhirubhai Ambani to Mukesh Ambani.

These are professionally managed.

For such companies, look at the shareholding pattern and see the holding of FII (Foreign Insitutional Investors) and DII (Domestic Institutional Investors). The percentage of holding by them should be high and should not be reducing significantly.

If a professionally managed business has increasing ‘Retail’ holding and reduction in holding by DII and FII – this could be a cause for concern. Retail investors are small investors like you and me. People who have limited inside-knowledge of companies.

These Retail investors with low-capital and less experience in the market – usually enter at the top when the stock price is high and sell when the stock price crashes. It’s the institutional investors who sell to individual investors at the top and buy back at the bottom.

Hence, we retail investors need to be extremely careful while investing.

Promoter Holding on MoneyControl

On the MoneyControl mobile application, search for any company and select it.

Then, just above the graph you should be able to see ‘Overview’ – scroll to the right. You will find ‘Shareholding’. Click on it.

Promoter Holding on Screener.in

It’s easy to find the Shareholding Pattern (which includes Promoter Holding) on Screener.

Visit Screener.in

Search for any company. Then scroll down. Towards the end of the page you should be able to see Shareholding Pattern.

Leave a Comment